[ad_1]

Wrapped Bitcoin is the main type of Bitcoin “wrapped” in a sensible contract on the Ethereum community. This enables it for use in Ethereum-based decentralized finance (DeFi) functions. WBTC is backed 1:1 to the worth of Bitcoin, so one WBTC is theoretically equal to 1 BTC.

BitGo is the principle WBTC issuer, which means they’re accountable for the BTC backing and custody. Alameda Analysis, Sam Bankman-Fried’s Prop Fund, was a WBTC high service provider, which implies they might settle for BTC from clients and ship it to BitGo to mint WBTC.

Whereas being a service provider doesn’t present entry into the custody, following the concern, uncertainty, and doubt (FUD) of FTX’s collapse, WBTC began to depeg below the idea that its reserves have been incomplete. This text analyzes WBTC on-chain indicators and the FUD across the asset’s depeg.

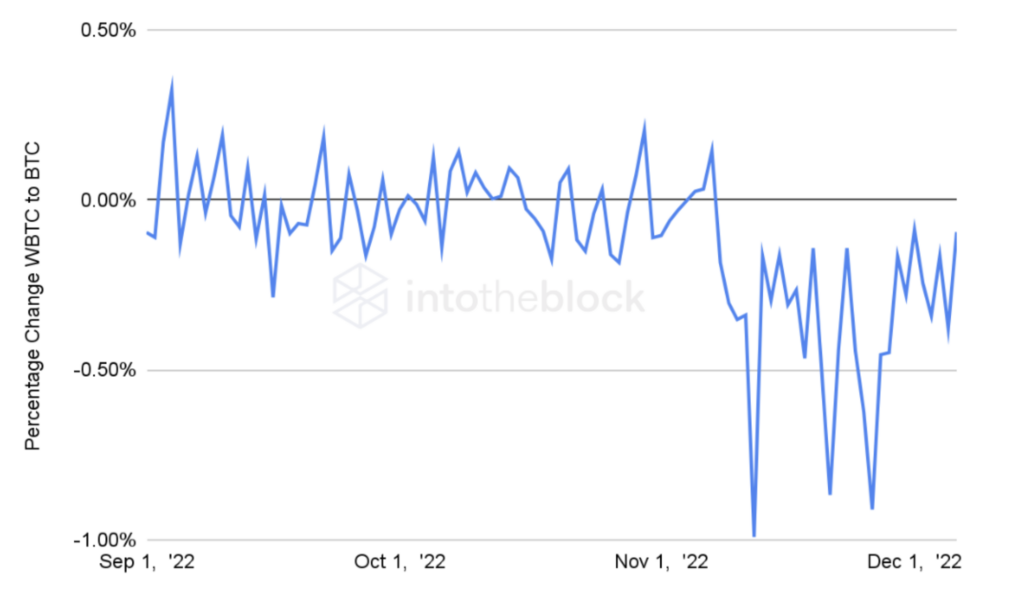

WBTC’s worth dropped by 1.5%, whereas FUD about its custody emerged. Small depegs can current necessary issues as they’ll lead customers to lose confidence within the pegged asset and the issuer. A depeg asset could also be perceived as a much less secure and dependable retailer of worth, which may trigger individuals to lose confidence in it and doubtlessly result in a lower in demand.

This could make it tougher for the issuer to take care of the peg and result in additional redemptions and loss in worth.

Moreover, within the case of WBTC, extensively used as a medium of trade throughout DeFi, its lack of worth could cause disruptions in your entire ecosystem. On this case, arbitrageurs might course of redemptions and produce the worth again to parity, because the BitGo crew confirmed its full backing of reserves and processed the redemptions submitted.

Furthermore, volatility additionally affected the markets throughout this time as merchants sought to safeguard their property from uncertainty.

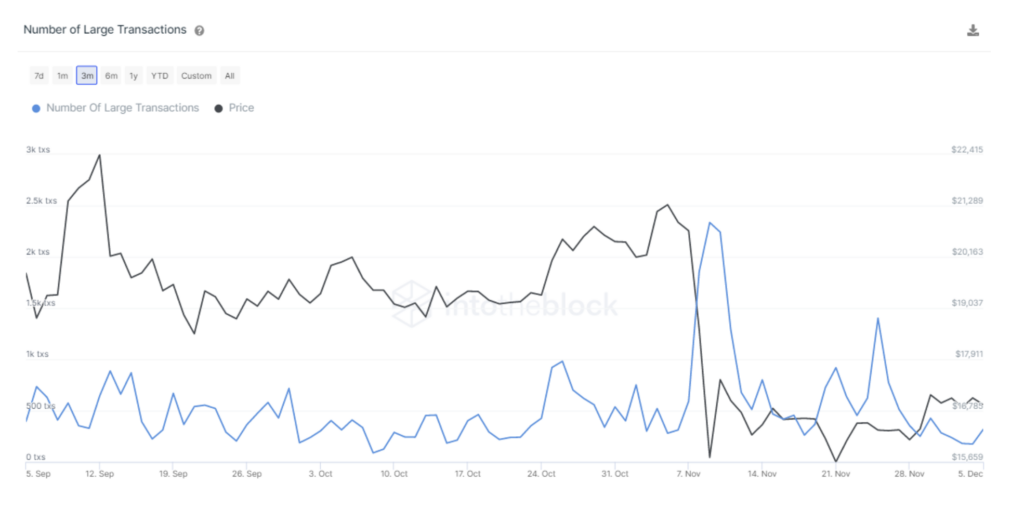

The indicator above exhibits the variety of transactions higher than $100,000. Since this sum of cash just isn’t out there to the typical retail dealer on-chain, the metric acts as a proxy to the variety of whales and institutional merchants that processed a transaction.

This helps perceive main token holders’ habits. As it may be seen, November twenty fifth was the second highest recorded variety of transactions after the date by which FTX collapsed in a 3-month spam. Transactions, on this case, can point out customers promoting or transferring an asset to be offered.

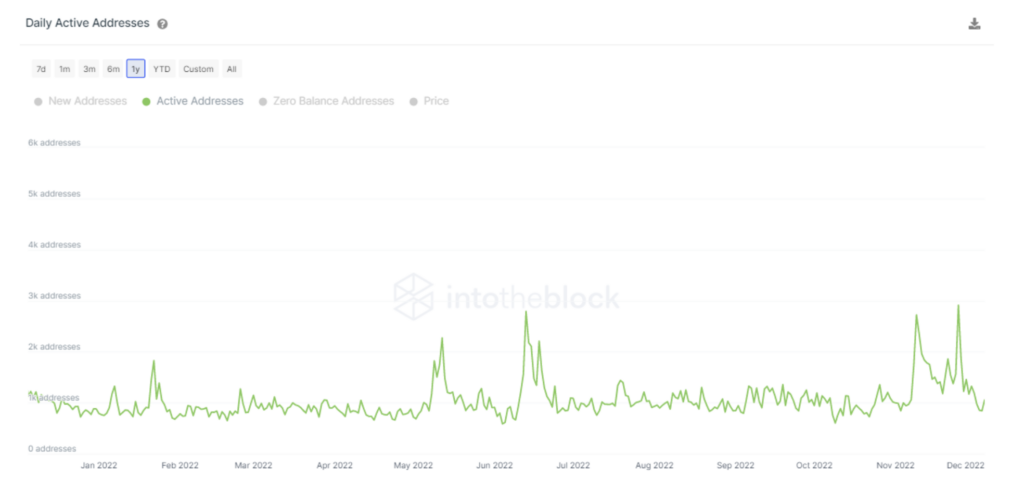

Whales and establishments weren’t the one ones anxious in regards to the underlying worth of WBTC, because the variety of “energetic addresses” on November twenty fifth was the very best recorded in multiple 12 months.

“Lively addresses” stand as addresses that make a number of on-chain transactions on a given day. This helps present the community exercise. On this case, it illustrates how individuals took precautionary measures in the direction of the asset depeg.

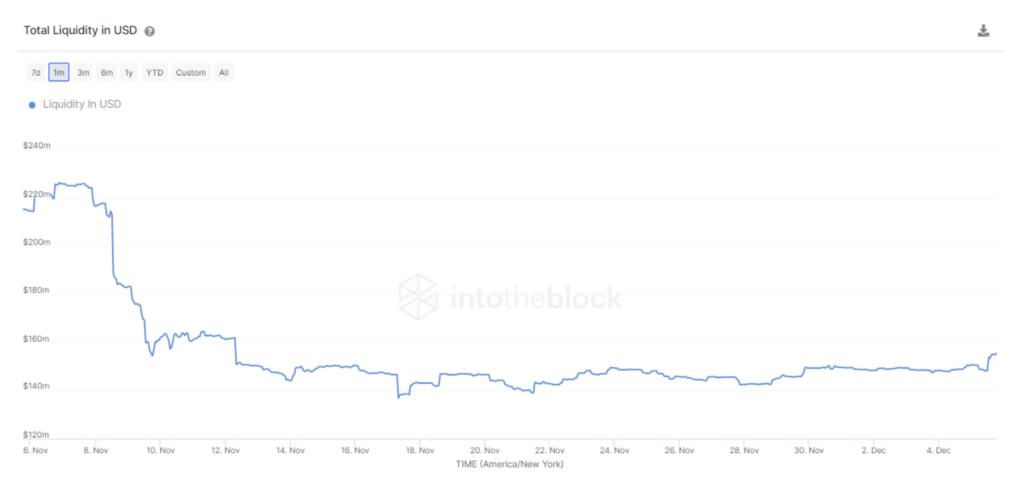

Regardless of many WBTC holders transferring and promoting their property, on-chain information reveals that Curve’s Tricypto2 pool liquidity was unaffected by these occasions. Slightly than being affected by the BitGo FUD, the pool skilled heavy withdrawals in the course of the FTX collapse. Tricypto2 at present stands as the largest market, when it comes to liquidity deposited, for buying and selling WBTC on-chain.

Liquidity is a vital issue within the functioning of a DEX, because it determines how simply customers should buy and promote property on the platform. A DEX pool with excessive liquidity could have numerous property out there for buying and selling, which makes it simpler for customers to purchase and promote the property they need.

This could enhance the attractiveness of the DEX pool to merchants and make it extra extensively used. On this case, the higher the liquidity within the pool the extra out there for customers eager to exit their WBTC positions.

Total, if a pegged asset begins to lose its worth, it could actually create a number of issues for each the issuer and the holders. Lack of confidence in its issuer can lead customers to doubt the worth of the pegged asset. Moreover, its depeg could cause main disruptions throughout the DeFi ecosystem. On this case, BitGo was in a position to make clear the misunderstanding that had been unfold round tweeter and supply proof of the custody reserves.

[ad_2]

Source link