The under is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Powell’s Speech And Contracting ISM PMI

We wish to zoom out and revisit the broader macroeconomic image and analyze a number of the newest information that got here out this week, which can closely affect the market path over the subsequent few months.

After Jerome Powell’s Brooking Establishment speech, it’s clear that markets are chomping on the bit to maneuver greater with any attainable Federal Reserve narrative and pivot situation. There’s over hedging, quick squeezes, choices market dynamics and compelled shopping for. That is past our experience to say precisely why markets are exploding with volatility on any given information level or new Powell speech. Nevertheless, some of these occasions and market actions have almost all the time been an indication of unhealthy and heightened risky swings in bear markets. Regardless of extra speak from Powell with nothing new actually stated, markets perceived the speech as extra “dovish” together with his commentary across the concern of overdoing charge hikes. But, if that is one other bear market rally taking form for the key indices, we appear to be near that rally turning over but once more.

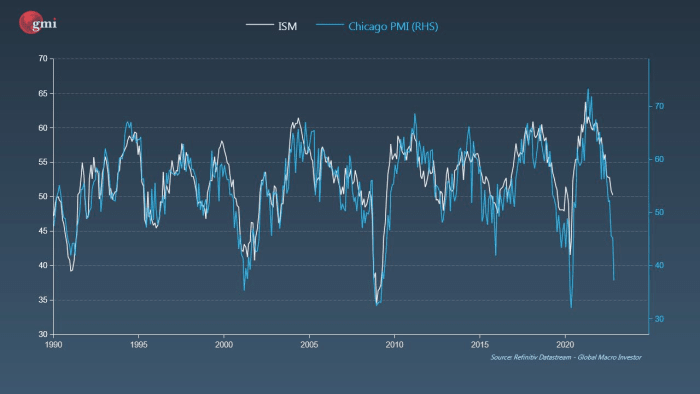

What can also be regarding and anticipated to proceed, is the development of financial contraction as informed by the info from the ISM manufacturing index (PMI). As we speak’s newest launch reveals a print of 49.0 under market expectations of 49.7. New orders are contracting, the backlog of orders are contracting and costs are lowering. By all measures and survey responses, these are the indicators of demand softening, situations worsening and the economic system transferring into extra cautious territory. The ISM PMI information extremely correlates to the much less impactful Chicago PMI information which simply printed contraction lows much like 2000, 2008 and 2020. That is the signal of an financial recession beginning within the manufacturing sector.

Supply: GMI, Julien Bittel

What does financial contraction imply for monetary markets? It’s sometimes unhealthy information when there’s a sustained contraction development of ISM PMI under 50 and even under 40s enjoying out. It appears we’re within the early phases of a bigger contraction development enjoying out: The despair section of the market.

The particular query for the bitcoin and macro relationship is now: Was this industry-leverage wipeout and capitulation occasion sufficient promoting to mute the potential chance and results of an fairness bear market meltdown? Will bitcoin flatline and type a backside if equities are to observe comparable previous bear market drawdown paths?

We’ve nonetheless but to see an actual blowout in inventory market volatility which has all the time impacted bitcoin. It’s been a core a part of our thesis this yr that bitcoin will observe conventional fairness markets to the draw back.

The magnitude of the long-duration debt in actual phrases was, and nonetheless is, the largest story right here.

Moreover, what does this imply going ahead for asset valuations?