In various latest interviews, the previous co-founder of FTX, Sam Bankman-Fried (SBF), defined that he “wasn’t working Alameda” and he “didn’t know the dimensions of their place.” In a newer dialogue with The Block’s Frank Chaparro, SBF defined that auditors had been FTX’s company financials, however the auditors had been “not buyer positions and never buyer danger.” This week, an FTX insider talking to Bitcoin.com Information underneath phrases of anonymity shared a doc that purportedly exhibits Alameda Analysis CEO Caroline Ellison’s private account was within the gap by $1.31 billion in Could 2022.

SBF Interviews Proceed to Spotlight a Large Margin Place That Went Bitter

There’s been a variety of data shared by the previous FTX co-founder Sam Bankman-Fried (SBF) throughout his interviews, and plainly someway, with out his data, a big margin account acquired uncontrolled. This has been blamed on “poorly-labeled accounting” practices and SBF stated he “f***ed up.”

“In a number of methods, frankly. When it comes to letting a margin place get too large, larger than I assumed it was. And never being thorough sufficient to catch that,” SBF advised New York Journal. The huge margin place, that took SBF off guard, has been referred to in lots of reviews about FTX and through SBF interviews.

“We must always not have allowed a margin place to get that large,” SBF harassed to New York Journal reporter Jen Wieczner. “It was too large. And it was too large, given the liquidity of the collateral,” SBF added. In one other assertion, SBF detailed that Alameda’s margin place was so large that it “was not going to be closable in a liquid approach with a view to make good on its obligations.”

“That place, looking back, looks as if it acquired considerably larger in the midst of the 12 months,” SBF added. The FTX co-founder continued:

That made it go from a considerably dangerous place to a place that was approach too large to be manageable throughout a liquidity disaster, and that it might be severely endangering the power to ship buyer funds.

Throughout SBF’s most up-to-date interview with The Block’s Frank Chaparro, the previous FTX CEO stated that regulators and auditors didn’t see any monetary holes as a result of buyer positions, and Alameda Analysis’s positions, weren’t included in FTX’s financials. SBF stated auditors checked out sure facets, however they had been “not buyer positions and never buyer danger.”

“This was successfully a buyer unfavorable place, and many purchasers had unfavorable positions open on FTX,” SBF advised Chaparro. “These weren’t a part of FTX’s property or liabilities, they had been buyer property and liabilities, and so FTX’s financials weren’t instantly impacted by this.” Chaparro’s interview additionally talks about how prime executives had been “prolonged giant private traces of credit score.”

FTX Insider Doc Supposedly Reveals Caroline Ellison’s Margin Place Was a $1.3 Billion Gap

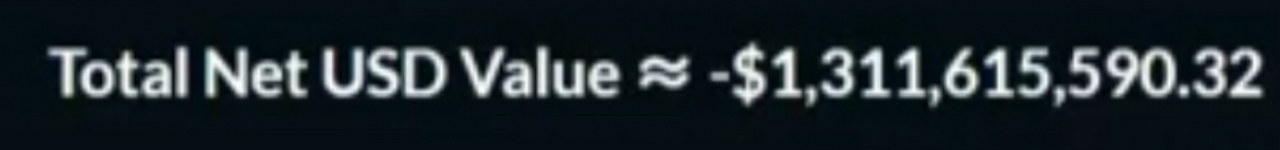

This week a doc was despatched to Bitcoin.com Information that allegedly exhibits Caroline Ellison’s stability on FTX seven months in the past in Could 2022. Based on the supply accustomed to the matter, Ellison shared this information amongst various FTX workers members when she was experiencing a technical glitch along with her private buying and selling account.

The doc exhibits Ellison ostensibly had a unfavorable stability at the moment of round $1.31 billion in Could 2022. All FTX accounts present unfavorable balances, if the person has a unfavorable stability for particular causes comparable to {that a} cost wasn’t settled or the person was in debt from margin positions. The documentation that’s allegedly tied to Ellison, exhibits an unlimited stability that no extraordinary person would have, together with a unfavorable amount of FTX fairness.

The doc our newsdesk seen signifies the person’s unfavorable stability owed or held in a margin place, factors to an enormous quantity of FTT, megaserum (MSRM), locked megaserum (MSRM), locked serum (SRM), locked maps (MAPS), solana (SOL), ethereum (ETH), bitcoin (BTC), and tens of millions of {dollars} price of stablecoins. The person’s stability, allegedly tied to Alameda CEO Ellison, exhibits practically each account is within the unfavorable to the tune of roughly $1.31 billion.

Chaparro notes across the 9:30 mark in his interview that Ellison talked about that FTX prolonged fairly a little bit of credit score to Alameda Analysis. “[Ellison] stated that you just knew, that Gary knew,” Chaparro pressed throughout his query, and he stated folks inside each corporations knew about these traces of credit score. “I feel she’s probably appropriate, that Alameda Analysis was successfully prolonged a considerable quantity of credit score by FTX and in the long run, that margin place turned underneath extreme stress and it blew out.”

A unfavorable $1.31 billion margin place, just like the one disclosed to our newsdesk this week, is a really giant gap. Margin positions confer with trades which are made utilizing borrowed funds and often, if the dealer is unable to keep up the minimal required margin, the place is liquidated with a view to repay the borrowed funds. The massive margin place shared in Could 2022, is across the similar time-frame the Terra LUNA fiasco occurred.

The insider that shared the doc purportedly tied to Ellison, requested “how can a buddy of SBF generate a debt” of that measurement “with no collateral?” There’s a variety of unanswered questions that circle again to Ellison and other people have been investigating the Alameda CEO for fairly a while. Ellison was reportedly noticed in New York this previous weekend with the FTX workplace canine referred to as ‘Gopher.’

What do you concentrate on the doc that supposedly exhibits Caroline Ellison had a unfavorable $1.3 billion margin place in Could 2022? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.