The crypto trade has at all times been extremely risky, however few might have predicted the turmoil it skilled in 2022. This yr has been unprecedented for the trade, with each facet affected by the collapse of Luna and FTX.

Other than retail buyers who took appreciable losses in these black swan occasions, Bitcoin miners stay those this disaster affected essentially the most.

However it’s not simply Bitcoin’s worth that’s retaining miners underwater.

Final yr, dozens of mining firms went public and bought low cost debt within the course of. The debt, initially supposed to develop their operations, has now change into a burden. Quickly declining crypto costs make it almost inconceivable for a lot of to service their loans whereas they battle with rising power costs and skyrocketing gear prices.

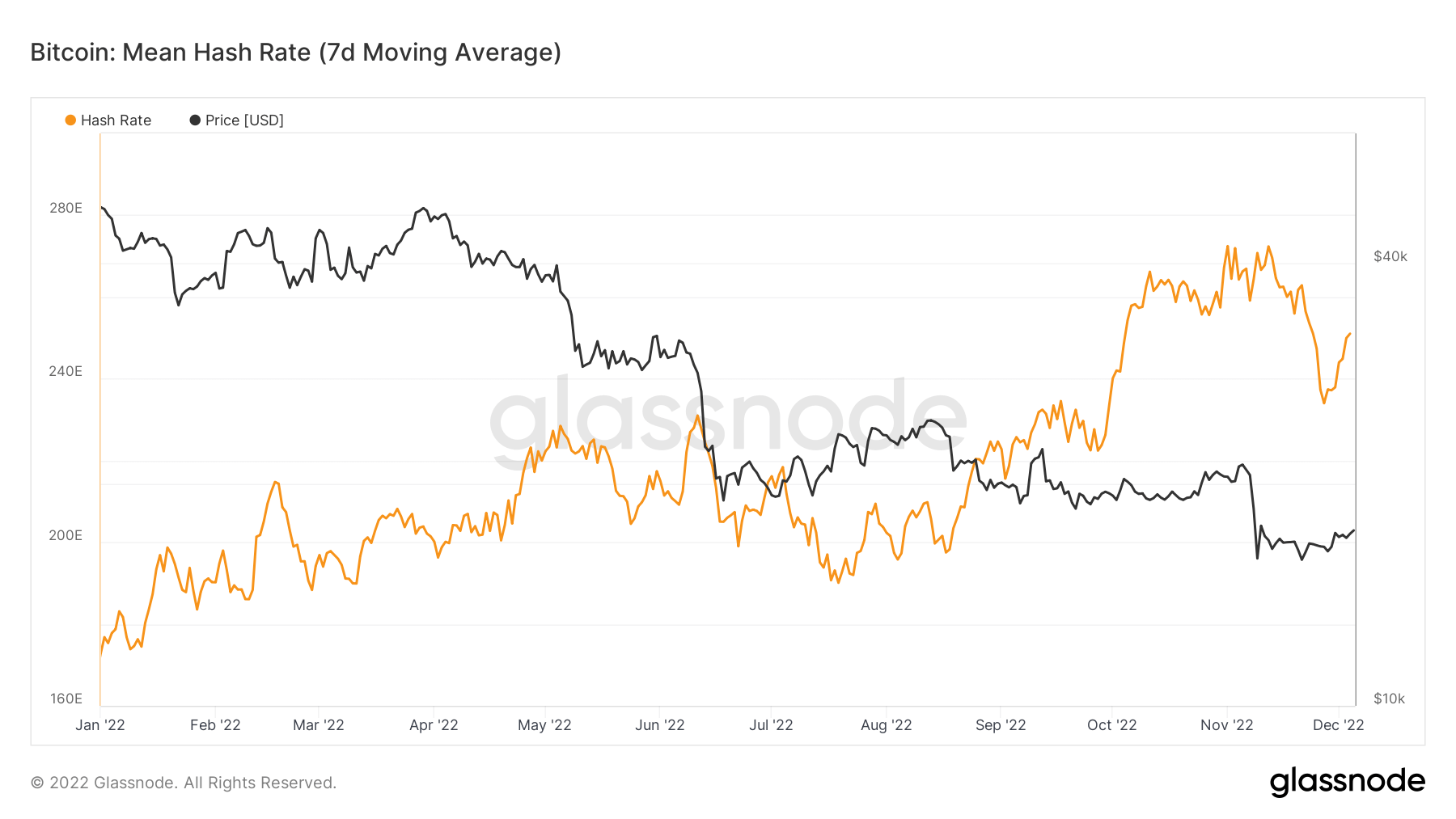

This has pressured many miners to scale back or utterly shut down their operations. Consequently, the 7-day common hash fee has decreased by 8.4% previously month, and 4.6% because the present issue epoch started.

Bitcoin’s hash fee peaked in mid-November after getting into a parabolic climb in August. Nevertheless, its quick rise was adopted by essentially the most important single-day decline since July 2021, dropping 13%.

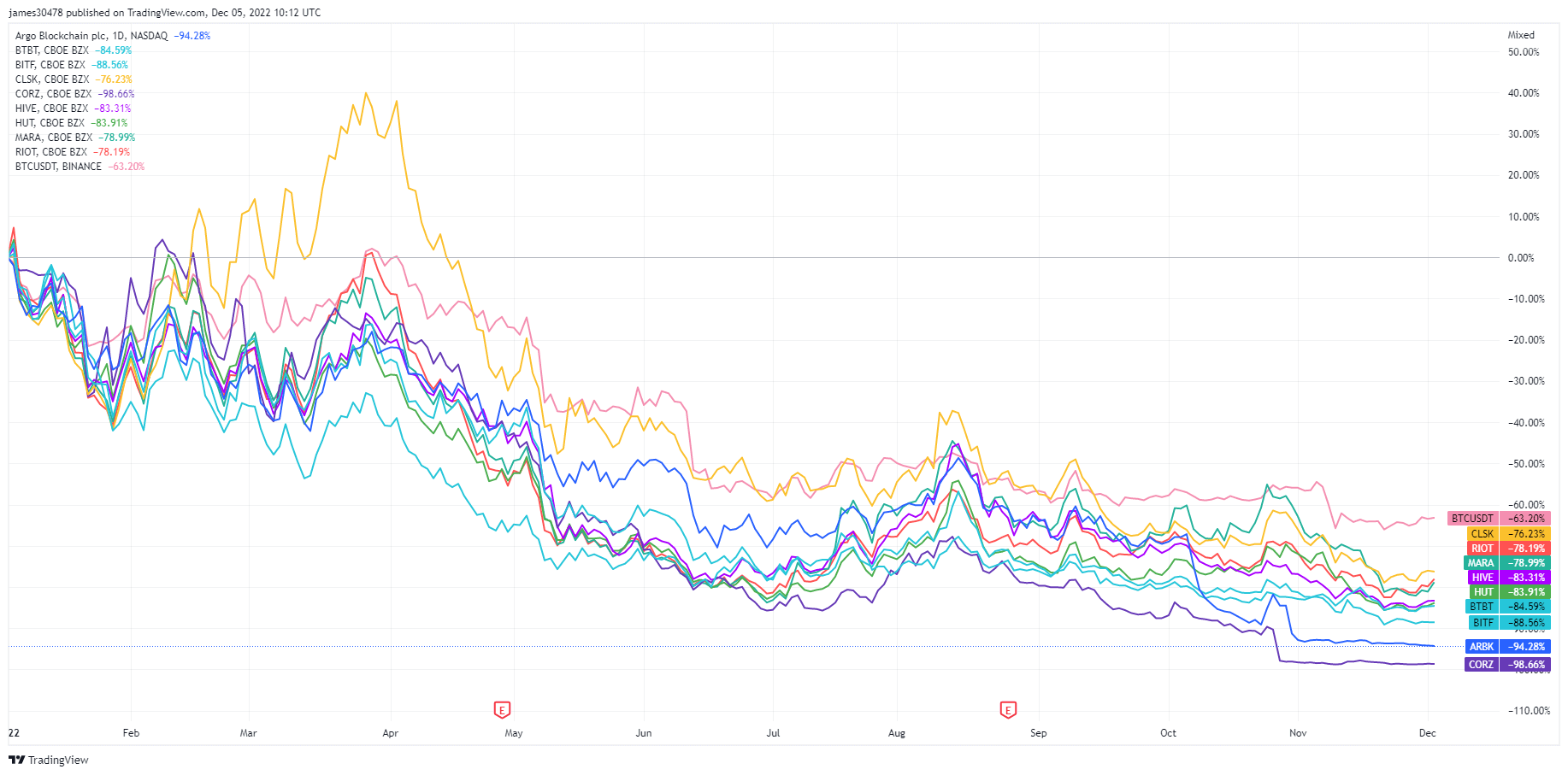

Up to now, the market has seen two main miner capitulation occasions this yr — one attributable to the collapse of Luna and the opposite attributable to the FTX fallout. Many public Bitcoin miners have emptied their Bitcoin stability sheets to remain afloat, negatively affecting their inventory costs.

Because the starting of the yr, the entire 9 largest public Bitcoin miners have seen their inventory worth plummet, with some shedding as a lot as 98.66% of their worth.

Nevertheless, the struggling trade might see some reduction within the coming days.

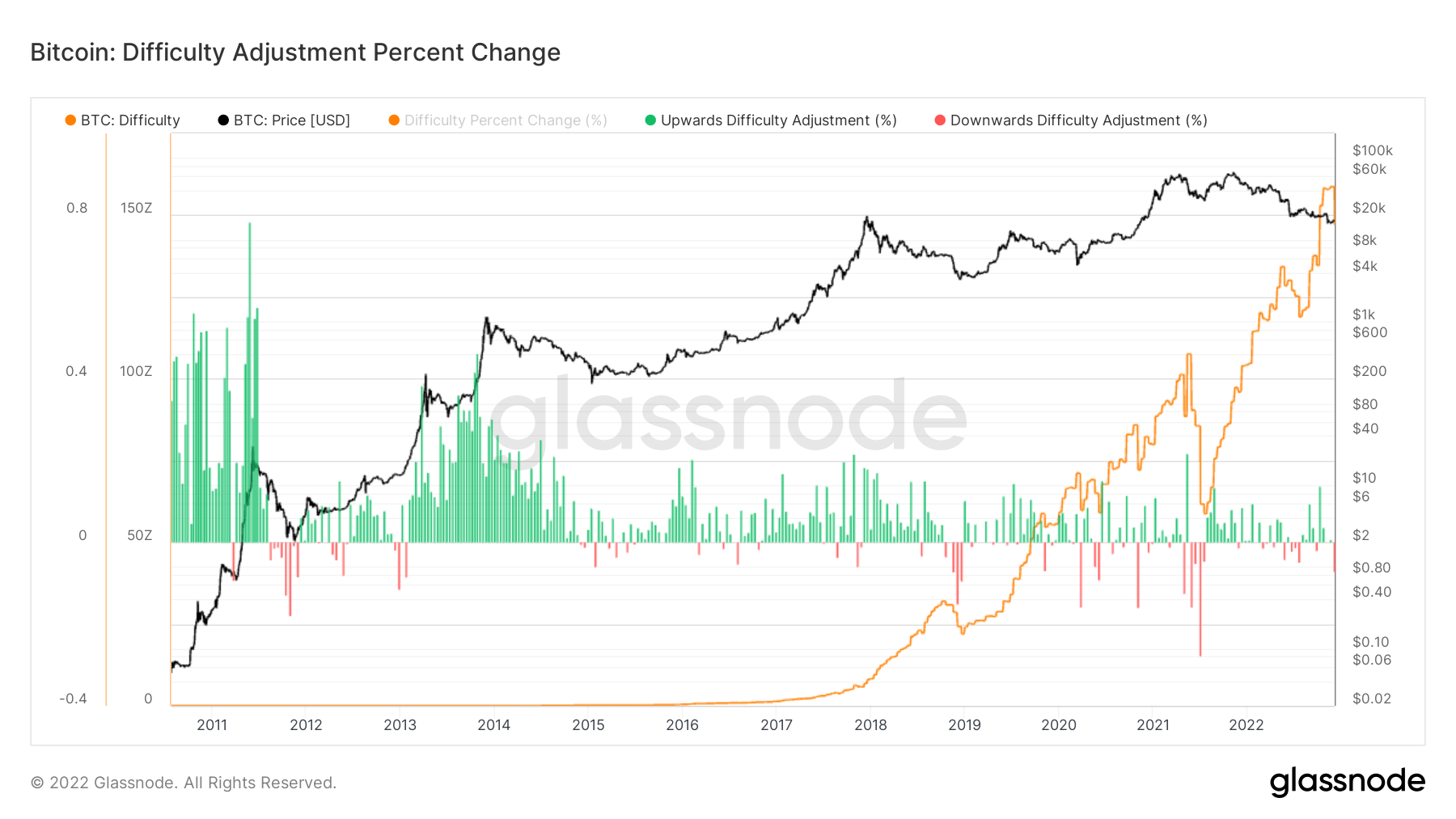

Bitcoin’s mining issue has dropped over 7% within the early hours of Dec. 6. Whereas the drop might sound insignificant on a big scale, it’s essentially the most important adjustment the trade had seen since July 2021, when China instated its controversial Bitcoin mining ban.

The 7.32% lower in issue will give miners reduction because the yr ends, offering no less than some assist to their skinny revenue margins. Nevertheless, we’re but to see how the worldwide hash fee reacts to the lower in mining issue, because it might take one other week earlier than a notable change is seen.

Nonetheless, Bitcoin’s mining issue stays twice as excessive as in June 2021. Furthermore, the worldwide mining issue has continued to extend all year long and is now thrice as excessive as in June 2021.