Bitcoin miners are dealing with a difficult time on account of ongoing value uncertainty and international vitality shortages.

As well as, macro elements have conspired to boost the price of borrowing, whereas entry to capital can also be drying up as threat urge for food dwindles within the face of recessionary pressures. This example is especially unhealthy for publically traded miners, who usually borrow to fund the acquisition of mining tools.

What’s extra, with the worth of Bitcoin floating in and round two-year lows, profitability stays tight for all however probably the most environment friendly miners.

On-chain Glassnode information analyzed by CryptoSlate reveals, since August, the BTC held by miners has dropped considerably. Nevertheless, it’s unclear whether or not this was pushed by the necessity to offload at exchanges.

Bitcoin held by miners

Glassnode’s Bitcoin: Steadiness in Miner Wallets metric identifies miners’ wallets and tracks the whole BTC provide held in these addresses.

The chart beneath reveals an uptrend in Bitcoin held by miners for the reason that begin of the yr. This peaked at 1.86 million BTC round August, resulting in a pointy drop-off, accelerating right into a near-vertical drop since November.

Market dynamics have sunk the variety of tokens held to roughly 1.81 million BTC at current, which equates to the identical stage seen round November 2021.

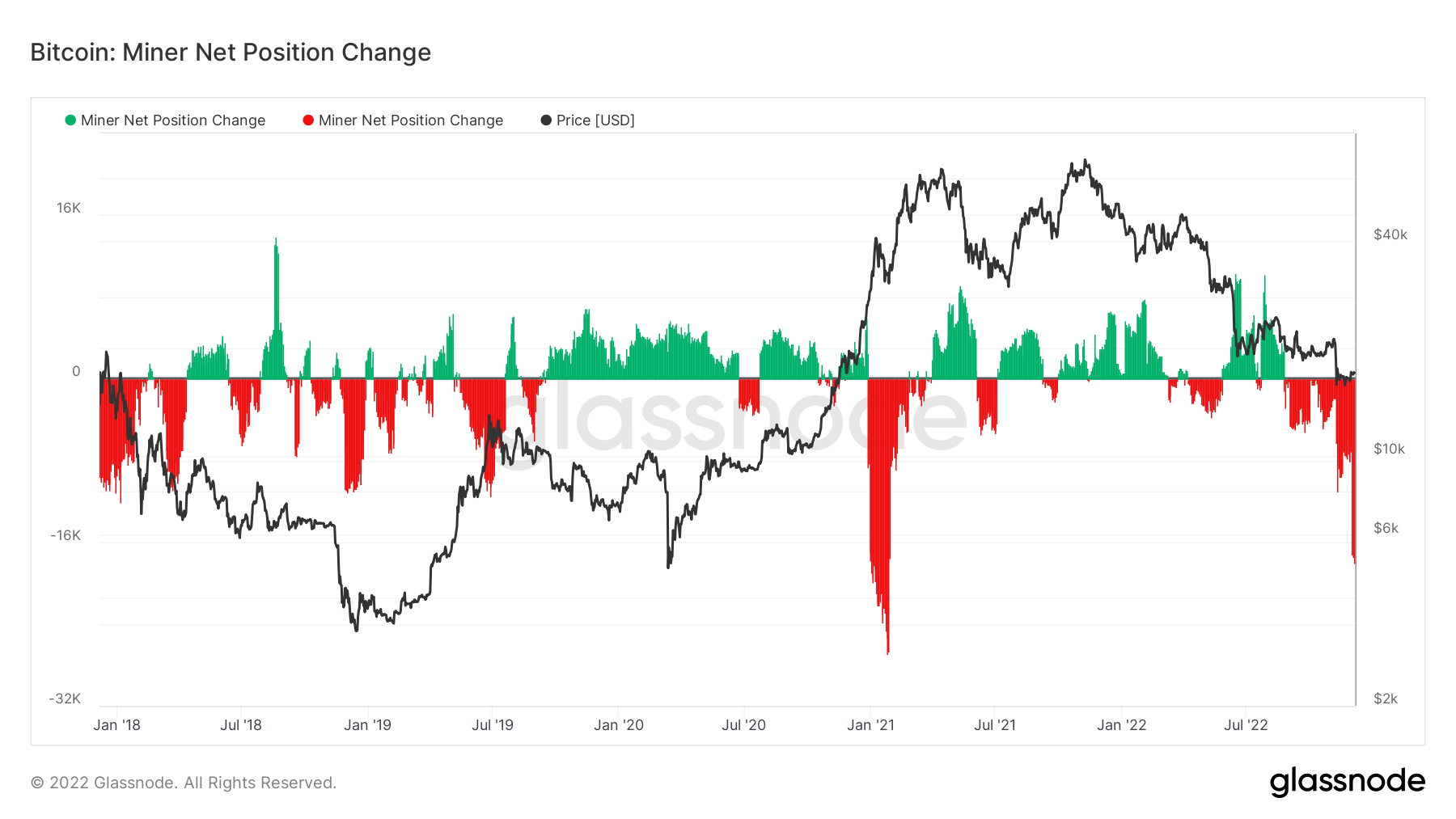

Miner Web Place Change

Miner Web Place Change appears to be like on the stream of Bitcoin into and out of miners’ addresses. Throughout occasions of stress, together with depressed value motion, in combination, miners are inclined to distribute their mining rewards, represented by outflows from the Web Place Change metric.

The chart beneath reveals present ongoing uncertainty has resulted in important outflows, from miners – dipping as little as round -20,000 BTC in current weeks.

Whereas the time period “outflows” is typically related to promoting on exchanges, it must be famous that within the case of the Miner Web Place Change metric, tokens leaving miners’ wallets may relate to transferring to chilly storage.

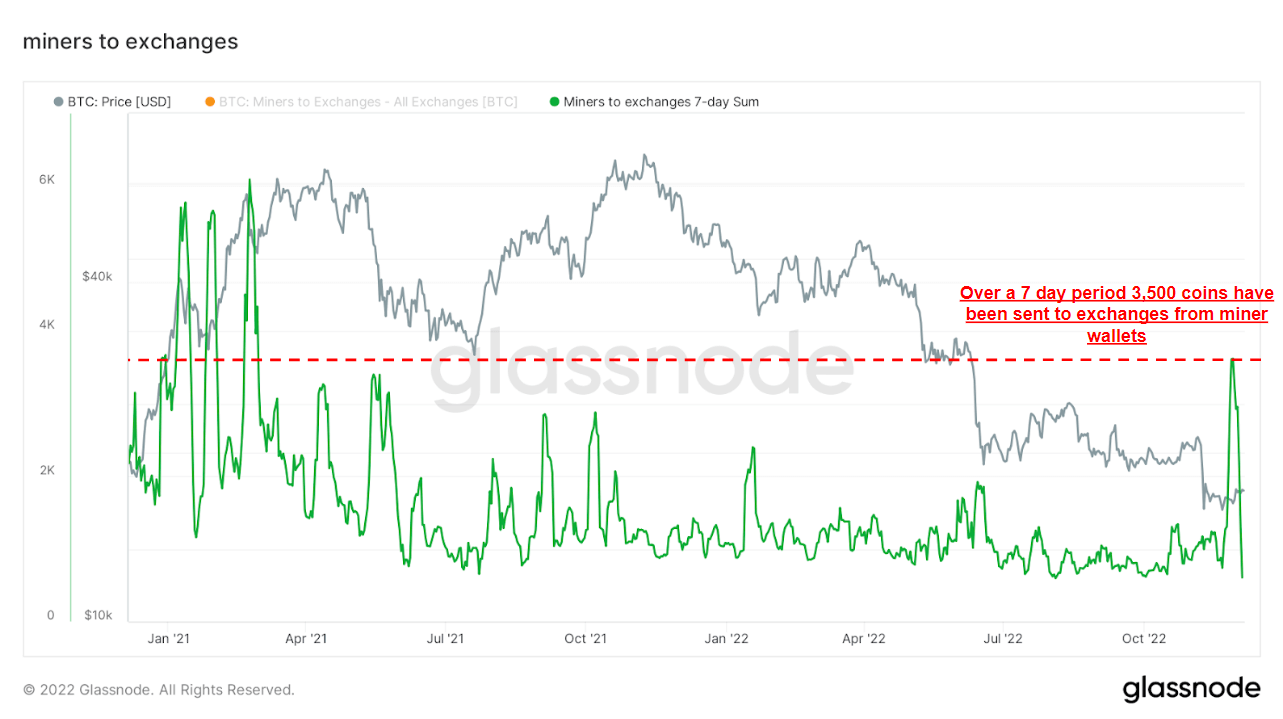

The chart beneath reveals simply 3,500 BTC have been despatched to exchanges from miners’ wallets over the previous week. This might counsel the vast majority of the drop in Bitcoin held by miners was for causes aside from promoting at an change.

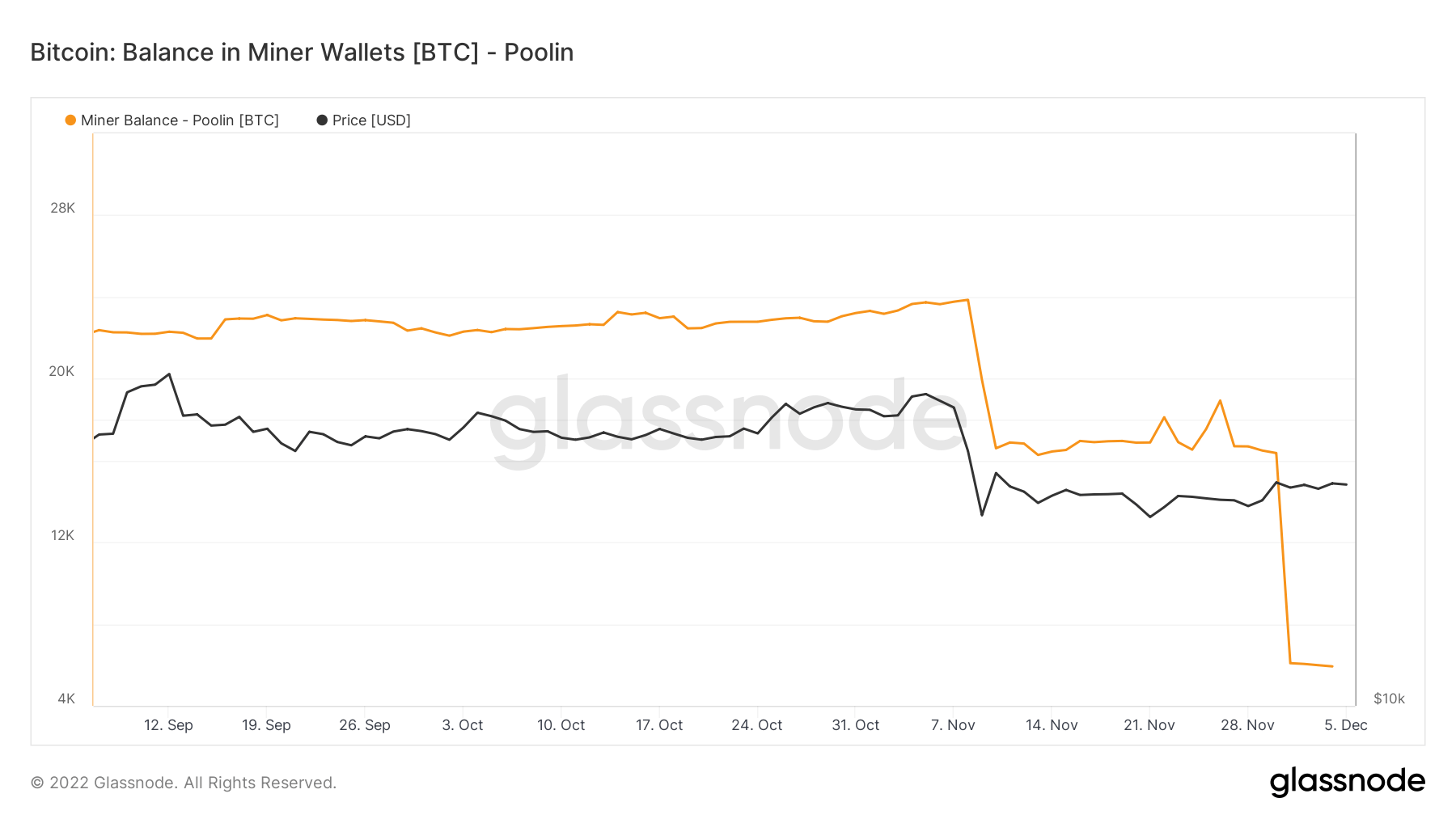

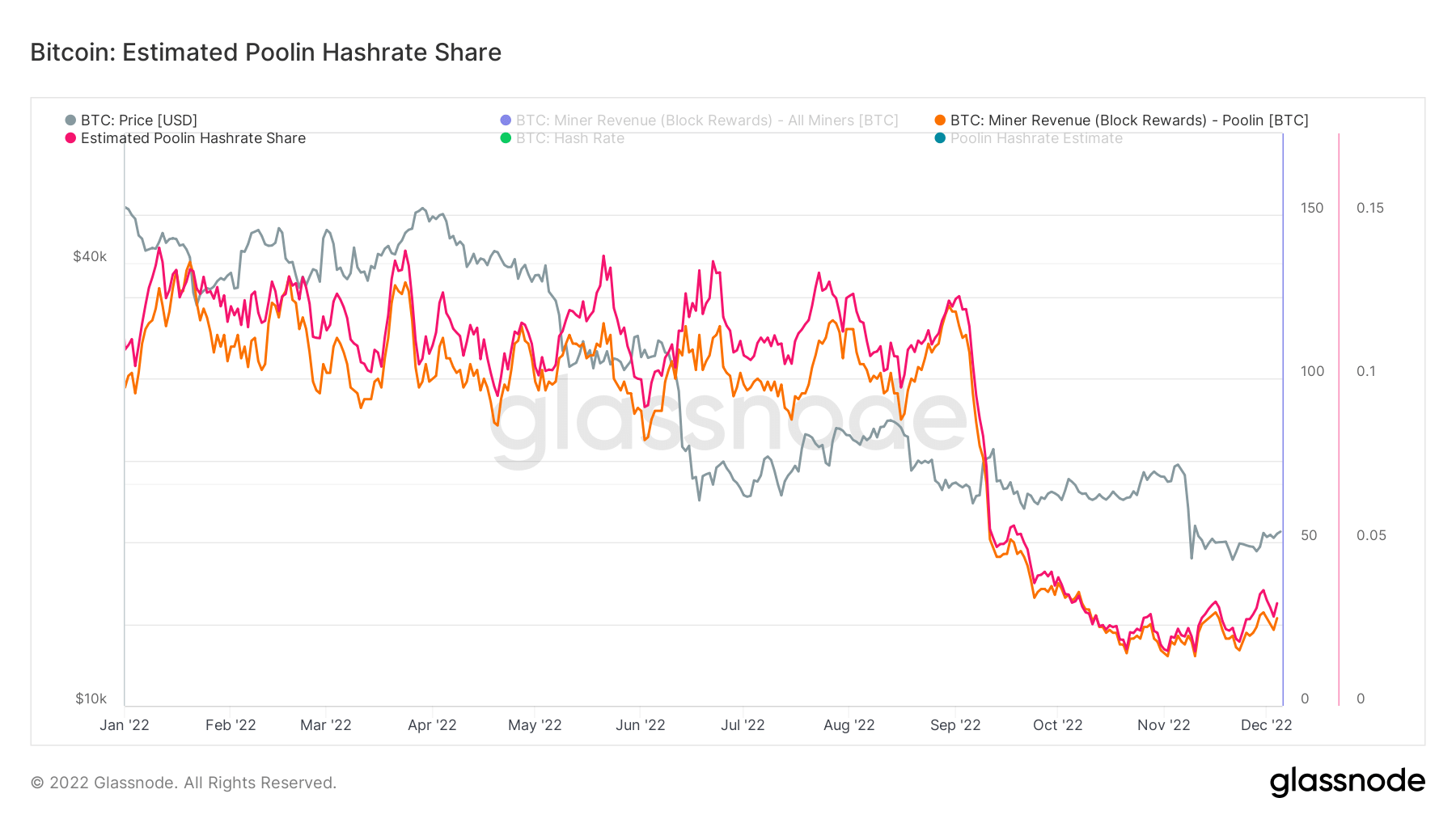

Poolin culpable

In early September, mining pool Poolin introduced liquidity points and a pause on the withdrawal of mining rewards.

Pre-announcement, Poolin was one of many prime mining swimming pools, accounting for 12% of the community’s general hashrate, and as excessive as 15% when the corporate was at its peak in 2020.

Nevertheless, the liquidity disaster triggered an exodus of taking part miners, resulting in Poolin’s share of the hashrate plummeting to 4% on the time.

Revisiting this, Poolin’s hashrate at the moment accounts for 3% of the community. What’s extra, in November, this fell as little as 1%, suggesting the corporate’s woes haven’t improved.

Evaluation of the Bitcoin held in Poolin wallets reveals a pointy dip from early November when the stability was hovering round 22,000 BTC. Following a comparatively secure stability over the following few weeks, one other sharp drop occurred in late November, dropping the stability held to round 6,000 BTC.

The approximate 16,000 BTC drop off from Poolin addresses account for a big chunk of the market’s general decline in balances held by miners.