The under is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

On-Chain Information Tendencies

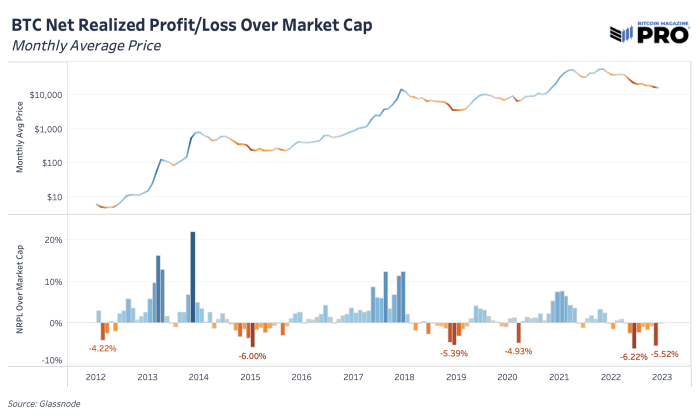

November was a painful month. By taking a look at on-chain realized revenue and loss knowledge, we will see that this was true for a lot of forced-sellers of bitcoin. Earlier than any bitcoin value backside, a trademark signal that you just wish to see is prolonged intervals of pressured promoting, capitulation and rise in realized losses. One technique to view that is by wanting on the sum of realized revenue and loss for every month relative to bitcoin’s whole market cap. We noticed these backside indicators in November 2022, and equally within the July 2022 Terra/LUNA crash, March 2020 COVID concern and December 2018 cycle backside capitulation occasions.

Web realized revenue/loss over market cap

Trying on the 2018 cycle, the top was marked by extra realized losses, though this was a lot completely different with the pressured liquidations and cascades of personal steadiness sheet leverage and paper bitcoin unwinding that we noticed this 12 months.

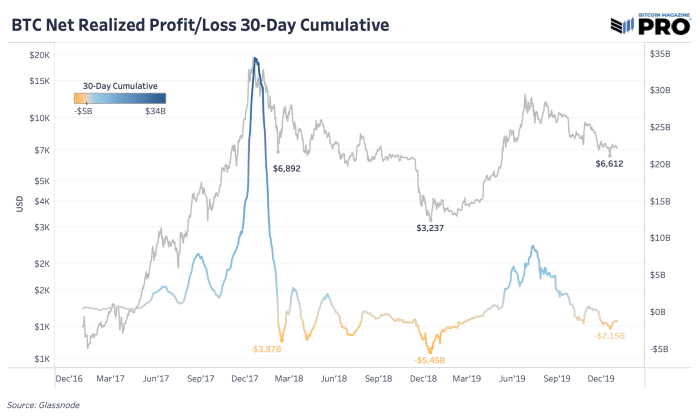

30-day cumulative internet realized revenue/loss

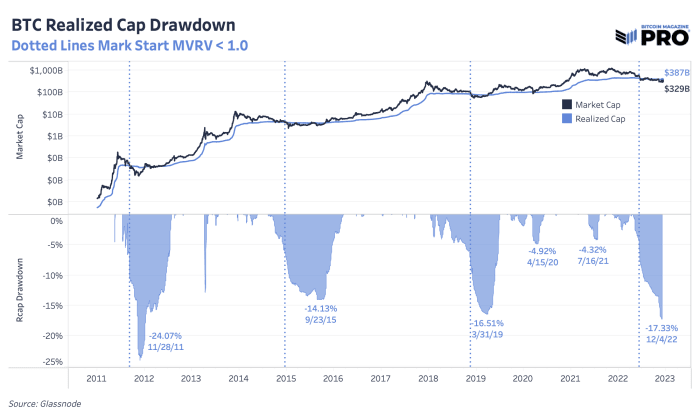

We’ve talked concerning the present drawdown in bitcoin’s value and the way that compares to earlier cycles many occasions over the previous couple of months. One other means to have a look at cyclical drawdowns is to concentrate on bitcoin’s realized market capitalization — the typical price foundation of the community which tracks the most recent value the place every UTXO moved final. With value being extra risky, realized value is a extra steady view of bitcoin’s progress and capital inflows. The realized market capitalization is now down 17.33% which is considerably increased than 2015 and 2018 cycles of 14.13% and 16.51%, respectively.

Bitcoin realized cap drawdown

As for period, we’re 176 whole days into the worth being under bitcoin’s realized value. These aren’t consecutive days as value can quickly go above realized value, however value developments under realized value in bear market intervals. For context, developments in 2018 had been short-lived at round 134 days and the developments in 2014-15 lasted 384 days.

On one hand, bitcoin’s realized market capitalization has taken a major hit within the earlier spherical of capitulation. That’s a promising bottom-like signal. Alternatively, there’s a case to be made that value being under realized value might simply final one other six months from historic cycles and the dearth of capitulation in fairness markets continues to be a serious headwind and concern.

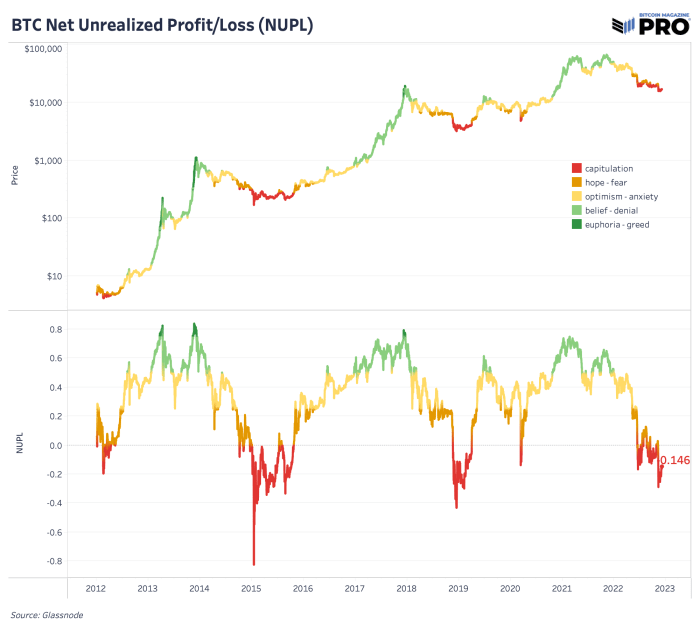

Web unrealized revenue/loss

As per the net-unrealized-profit/loss (NUPL) ratio, we’re firmly within the capitulation part. NUPL might be calculated by subtracting the realized cap from market cap and dividing the outcome by the market cap, as described on this article authored by By Tuur Demeester, Tamás Blummer and Michiel Lescrauwaet.

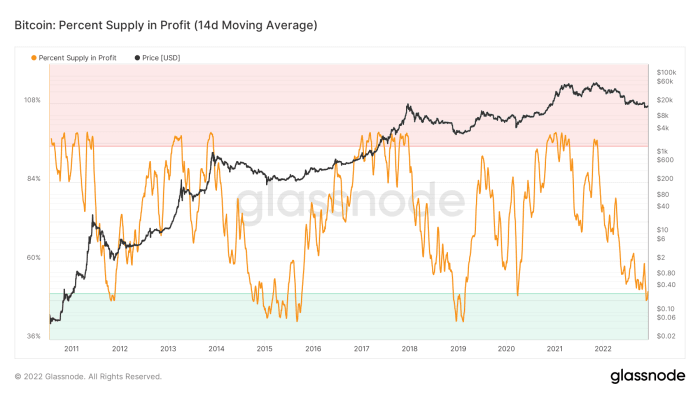

There is no such thing as a denying it: For bitcoin-native cycles, we’re firmly within the capitulation part. Presently, solely 56% of circulating provide was final moved on-chain in revenue. On a two-week transferring common foundation, below 50% provide was final moved above the present change price, which is one thing that has solely ever occurred within the depths of earlier bear-market lows.

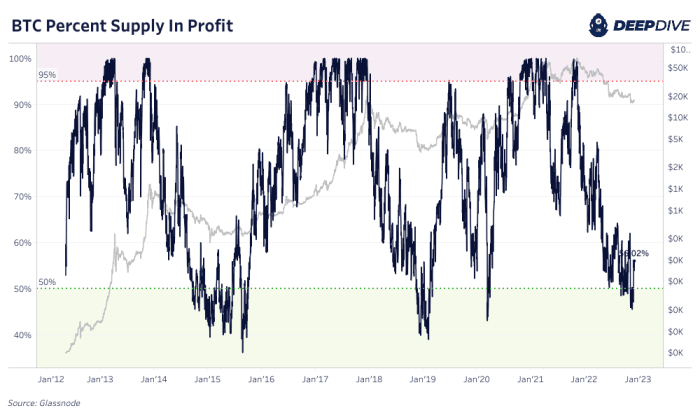

P.c of bitcoin provide in revenue

14-day transferring common of the p.c of bitcoin provide in revenue

When pondering of the bitcoin change price, the numerator aspect of the equation is traditionally low cost. The Bitcoin community continues to supply a block roughly each 10 minutes in an unabated trend, as hash price ticks increased and because the ledger provides an immutable settlement layer for international worth. The hypothesis, leverage and fraud of the earlier cycle is washing to shore and bitcoin continues to change fingers.

Bitcoin is objectively low cost relative to its all time historical past and adoption phases. The true query over the quick future is the denominator. We have now talked at size concerning the international liquidity cycle and its present observe. Regardless of being traditionally low cost, bitcoin shouldn’t be proof against a sudden strengthening within the greenback as a result of nothing really is. Change charges are relative and if the greenback is squeezing increased, then every thing else will subsequently fall — at the least momentarily. As all the time, place sizing and time choice is vital for all.

As for the catalyst for a surge increased within the greenback denominator of the bitcoin change price (BTC/USD), there are 80 trillion potential catalysts…