Danger is off the desk

Danger, leverage, and hypothesis might be thought-about the key phrases for 2021 as extra money from covid stimulus entered the inventory market and crypto ecosystem. Many conventional monetary belongings have since returned to their pre-covid ranges, resembling Ark Innovation ETF, public equities resembling Coinbase, and Bitcoin mining shares making all-time lows. Nonetheless, Bitcoin remains to be up round 5x from its covid lows.

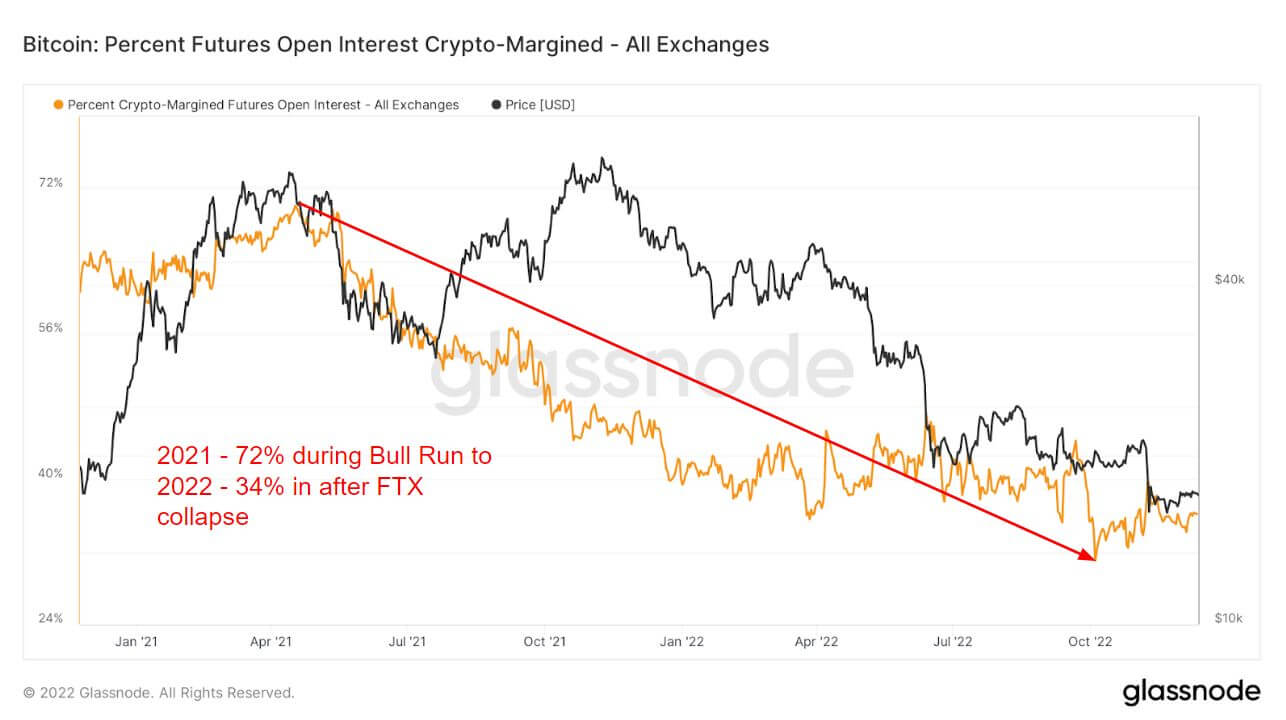

The introduction of derivatives was a giant a part of the 2021 bull run, which allowed buyers to tackle extra danger, and hypothesis. One avenue is futures open curiosity, the full quantity of funds (USD Worth) allotted in open futures contracts.

The 2021 bull run noticed 72% of all collateral used for futures open curiosity was crypto margin, i.e., BTC. Because the underlying asset is unstable, this is able to add additional volatility and danger to leveraged place.

Nonetheless, as 2022 approached and danger collapsed, buyers used as little as 34% of the margin in crypto. As a substitute, they moved to both fiat or stablecoin to hedge towards the volatility, as both instrument just isn’t unstable by nature. Crypto margin has been lower than 40% because the Luna collapse, which signifies risk-off and has stayed flat for the rest of 2022.

Drastic divergence in futures between 2021 and 2022

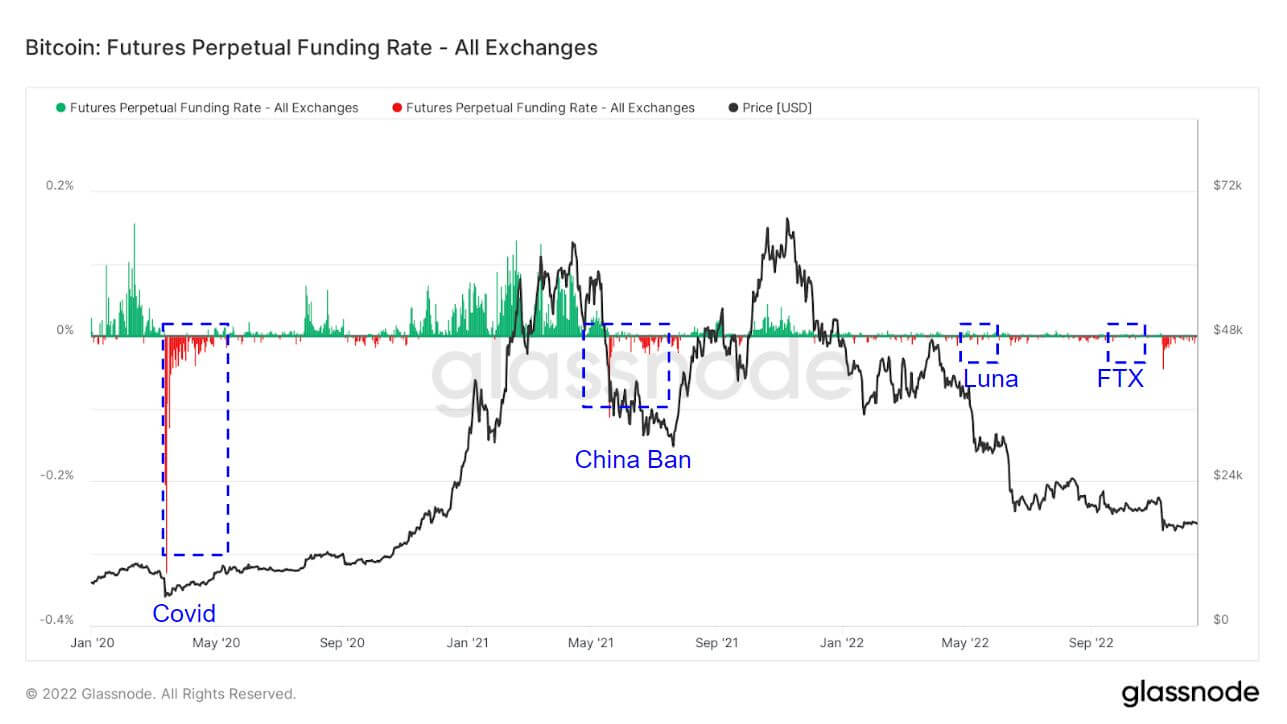

The perpetual swap funding charges throughout 2021 had been primarily buyers going lengthy and indicated buyers had been more and more bullish on BTC. Nonetheless, funding charges in 2022 have been considerably muted in comparison with 2021.

The typical funding fee (in %) set by exchanges for perpetual futures contracts. When the speed is optimistic, lengthy positions periodically pay brief positions. Conversely, when the speed is destructive, brief positions periodically pay lengthy positions.

Highlighted are areas when buyers take the wrong way and brief the market. It simply so occurs it coincided with black swan occasions. Covid, China banning BTC, Luna, and the FTX collapse noticed an enormous shorts premium. That is normally a low within the cycle for BTC or an area backside as buyers attempt to ship BTC as little as potential.

Because of much less leverage available in the market, liquidations in 2022 have been muted in comparison with 2021, the place buyers had been being liquidated billions of {dollars} in early 2021; 2022 is now simply hundreds of thousands.

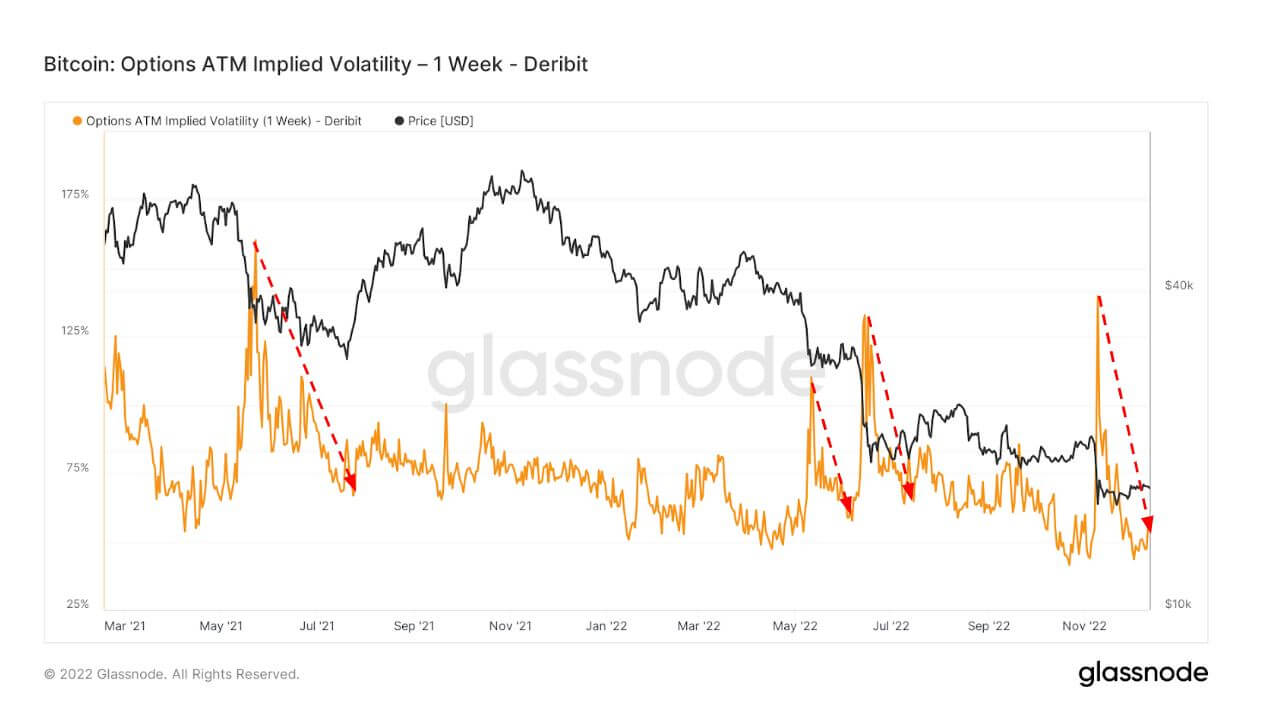

Volatility and put choice premiums eroded

Implied Volatility (IV) is the market’s expectation of volatility. Given the worth of an choice, we will resolve for the anticipated volatility of the underlying asset.

Over time, viewing At-The-Cash (ATM) IV provides a normalized view of volatility expectations, which can usually rise and fall with realized volatility and market sentiment. This metric reveals the ATM IV for choices contracts that expire 1 week from right now.

After the chaotic 12 months of 2022, the Bitcoin ecosystem is filtering out right into a muted December. Choices volatility has collapsed, which has completed so after every black swan occasion, at present at multi-year lows of 40%.

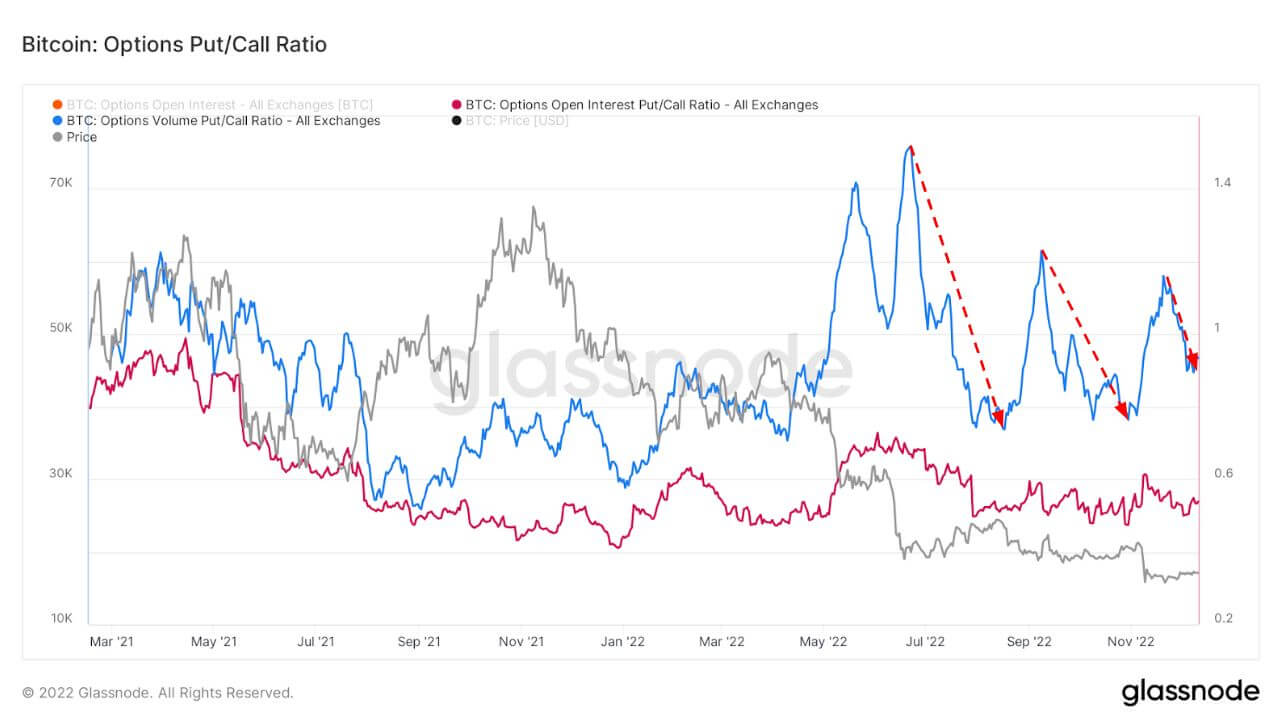

This chart presents the Put/Name Ratio for Choices markets, introduced for Open Curiosity (purple), and traded Volumes (blue).

When danger and volatility happen, places are usually positioned at a better premium which could be seen beneath. After the Luna and FTX collapse, the premium for put choices eroded, which has additionally been a superb indicator throughout this bear market.

Retail taking self-custody

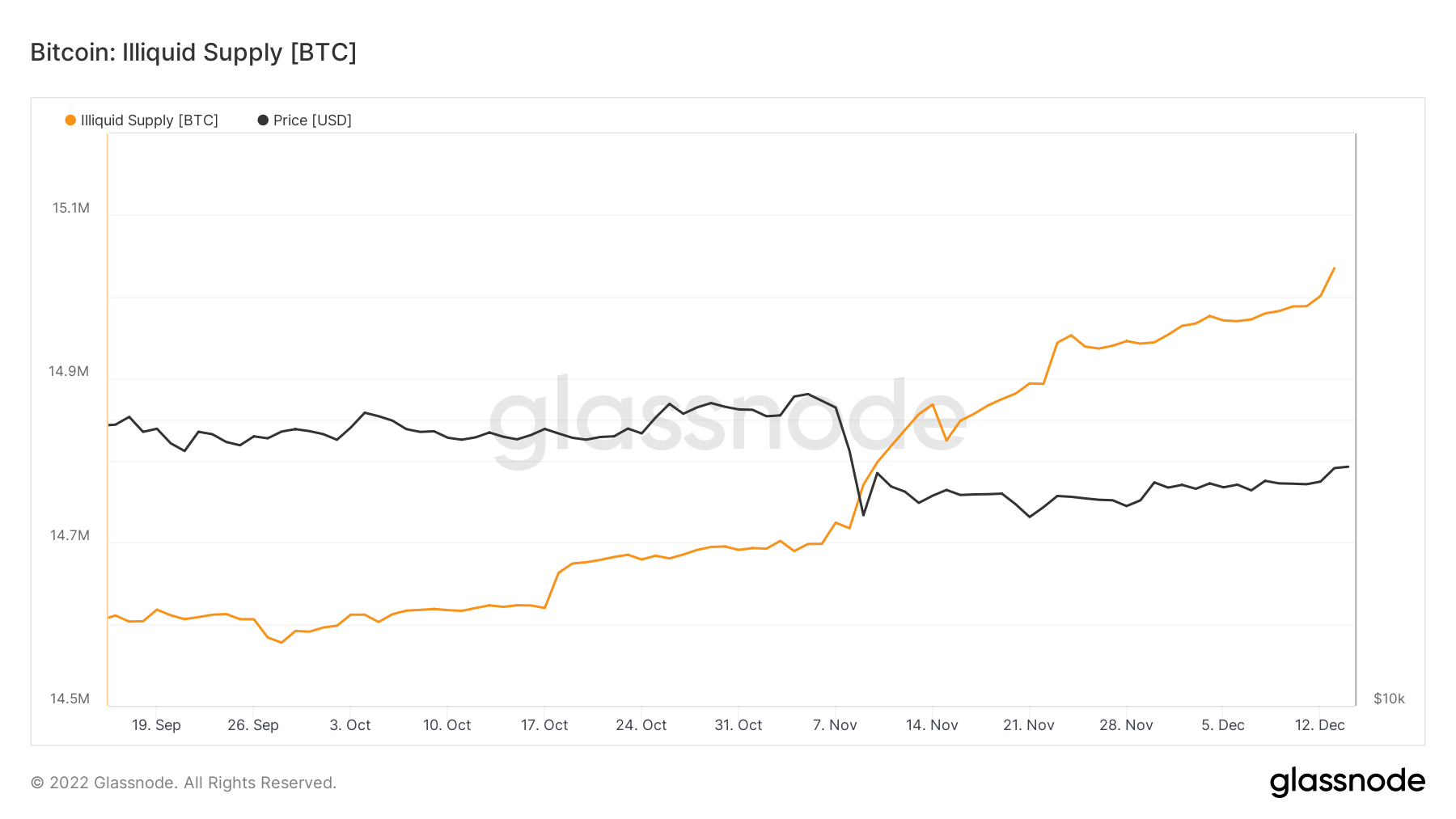

Illiquid provide simply handed by 15 million cash held in chilly or sizzling storage wallets. Because the circulating provide of BTC is round 19.2 million, this is able to make up 78% of all cash within the circulating provide held by illiquid entities.

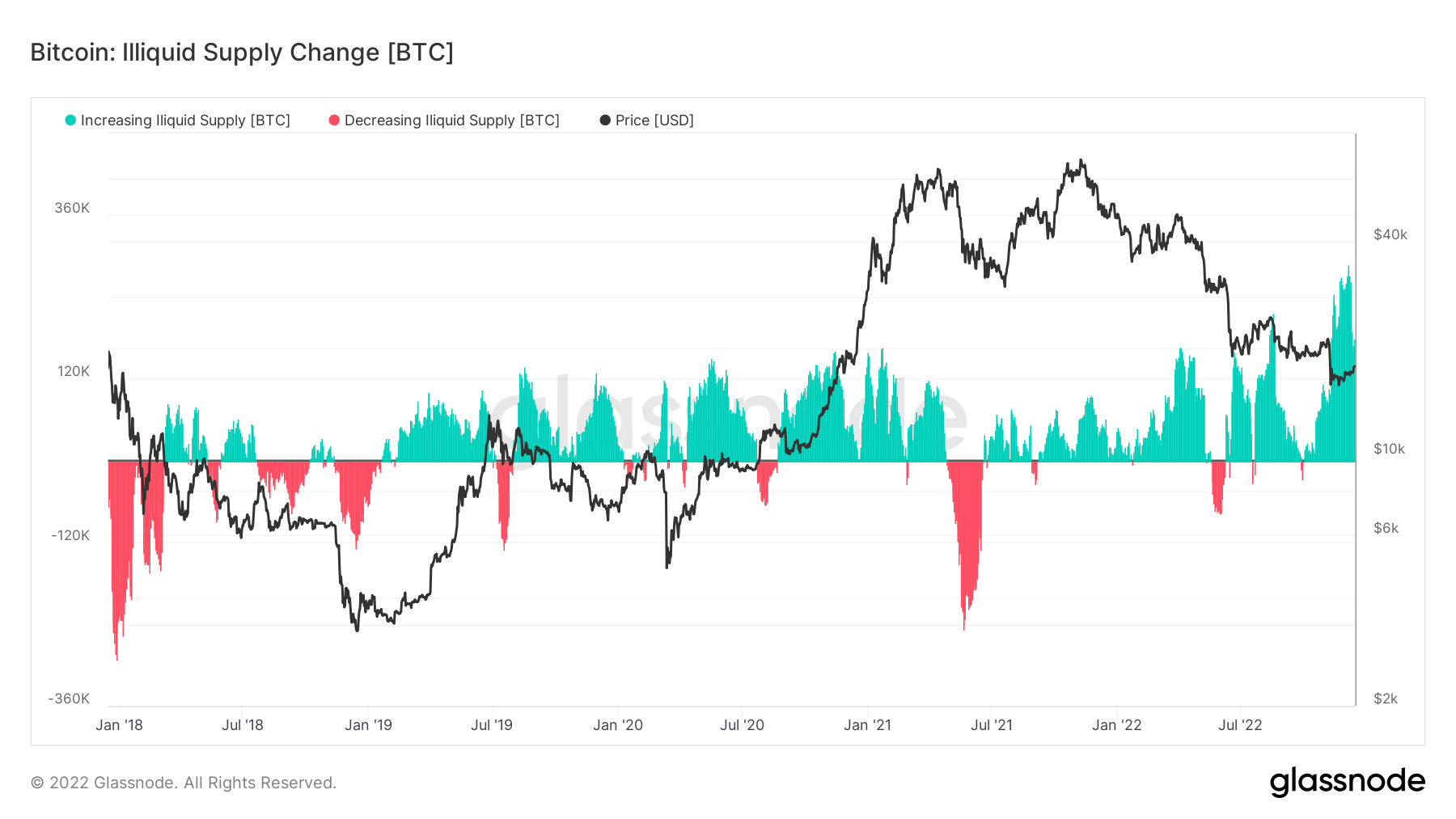

Self-custody has been a central focus because of the collapse of FTX, and previously three months, the speed of change of illiquid provide has been the very best for over 5 years, displaying that cash are leaving exchanges.

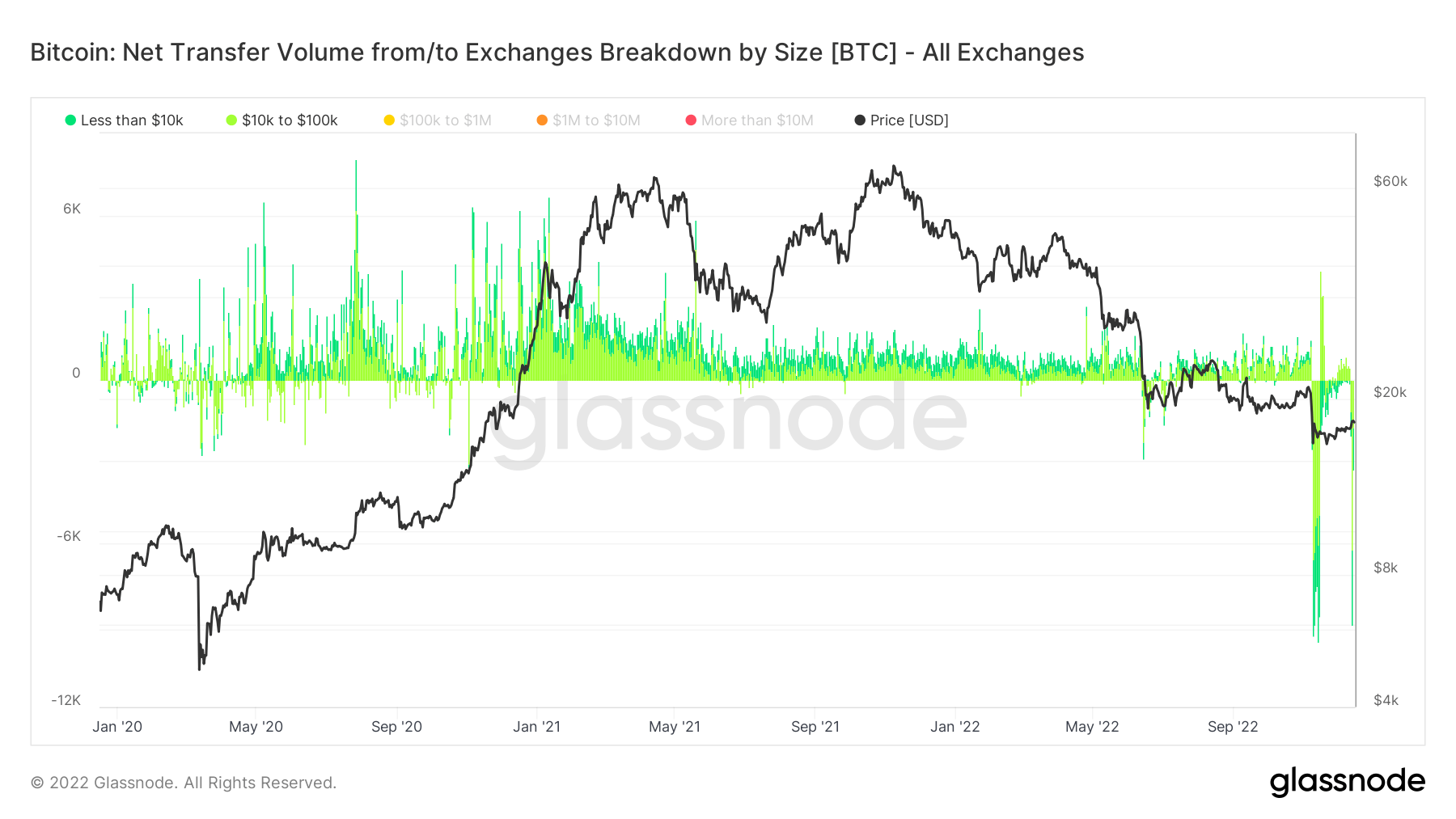

Understanding the buyers taking their cash off exchanges is completed by the metric, Internet Switch Quantity from/to Exchanges Breakdown by Dimension.

Deciding on beneath $100k insinuates retail transactions, which noticed $160m being withdrawn on a number of events throughout the FTX collapse and, most not too long ago, a lot of withdrawals from Binance, the week commencing Dec. 12.

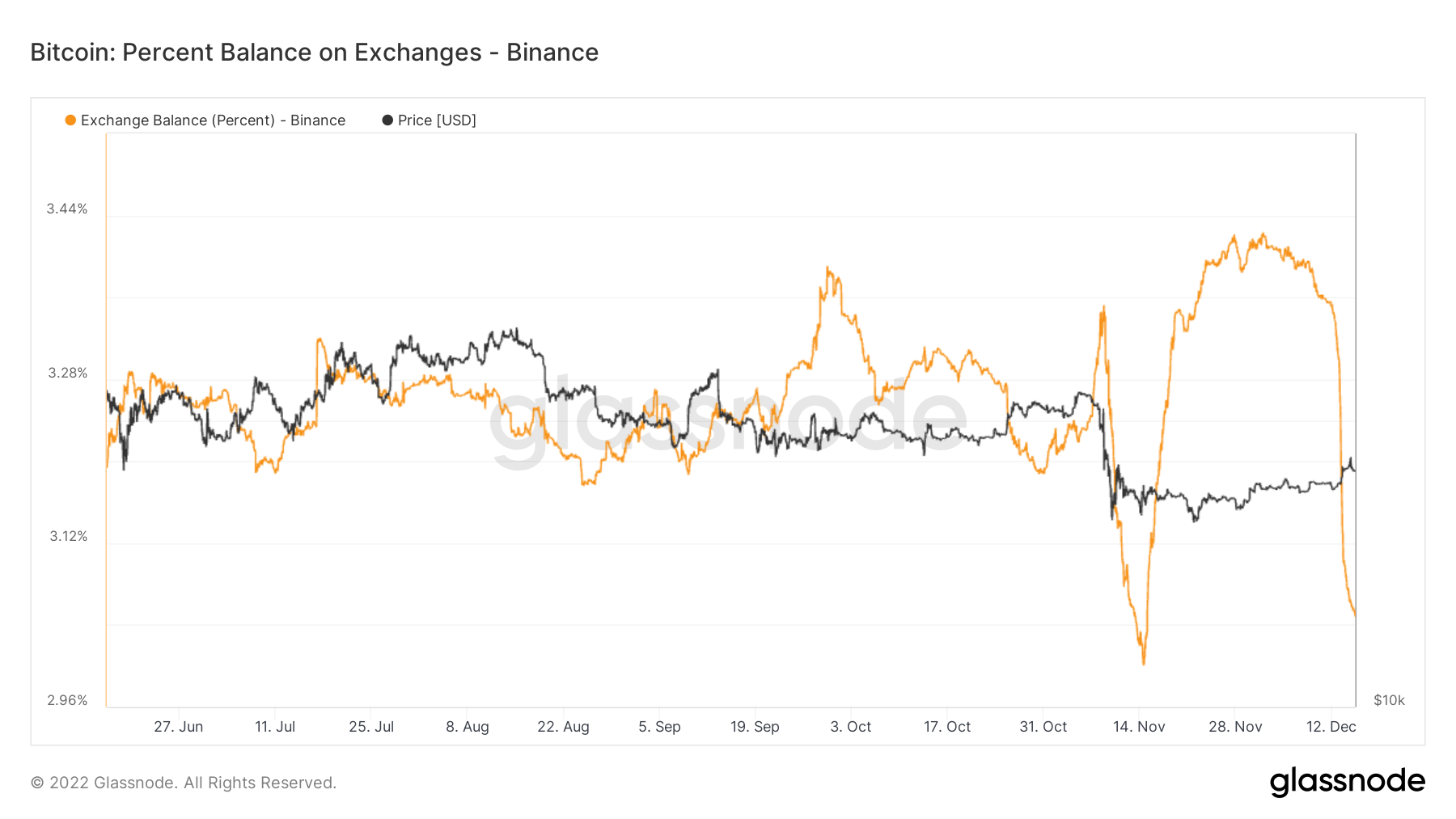

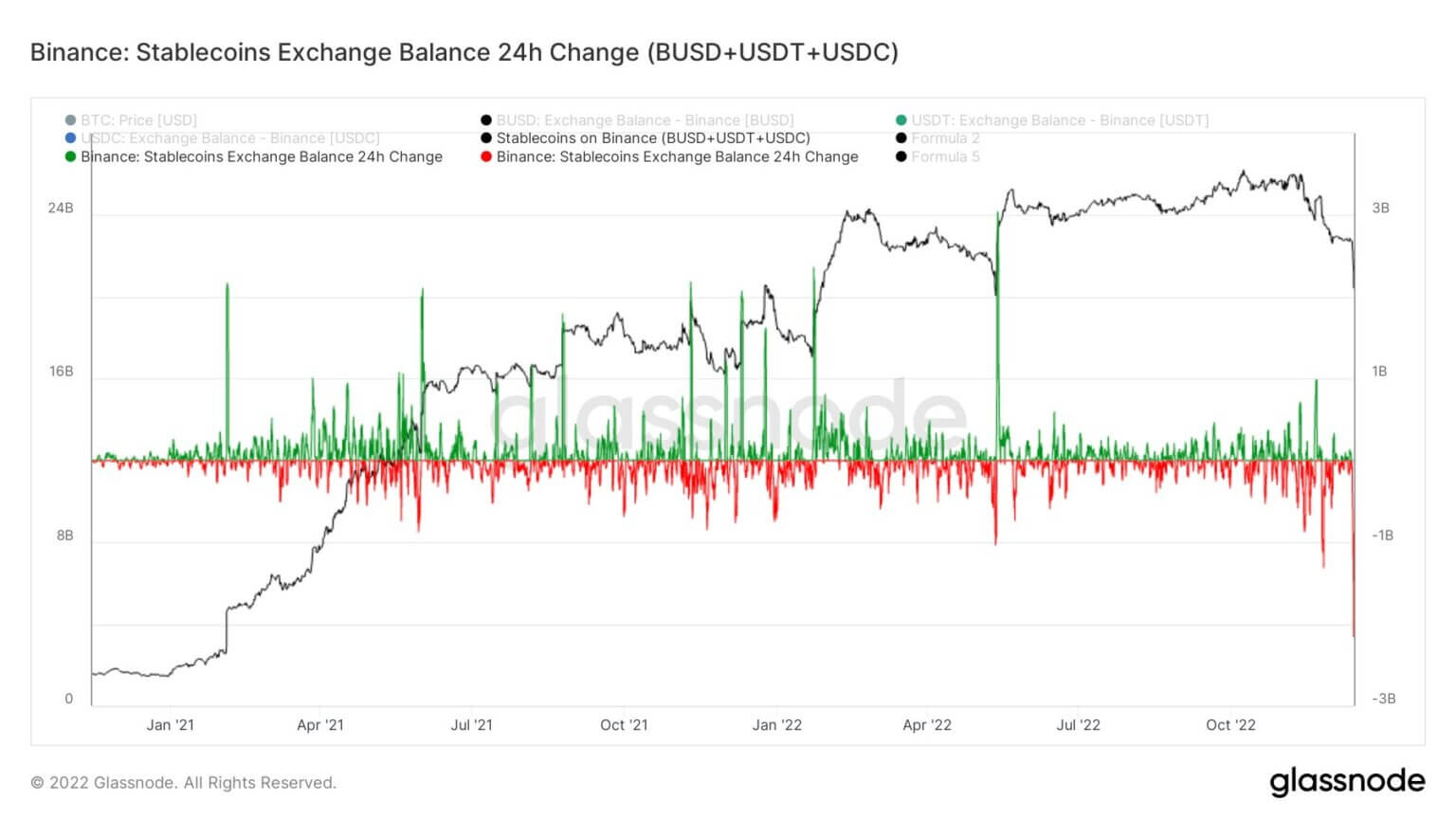

Mass exodus of cash leaving Binance

Binance noticed unprecedented outflows of cash this week, leaving their trade. Their proof of reserves fell by $3.5 billion, whereas Ethereum-based token withdrawals amounted to over $2 billion. Nonetheless, they managed redemptions and withdrawals seamlessly.

Binance confronted the most important stablecoin (BUSD+USDT+USDC) outflows in 24 hours, amounting to $2.159 billion.

Binance has seen over 65,000 BTC depart their trade over the previous seven days. Whereas its trade stability depletes, they nonetheless maintain round 3% of the Bitcoin provide on exchanges – simply because the Bitcoin provide on exchanges drops beneath 12% for the primary time since January 2018.