2022 is coming to an finish and over the past 12 months, the crypto economic system has misplaced roughly $1.486 trillion in worth in opposition to the U.S. greenback. On Dec. 20, 2021, bitcoin was buying and selling for $46,406 and it has misplaced greater than 63% in worth year-to-date, whereas the second main crypto asset ethereum shed 69% in opposition to the buck over the past 12 months.

2022’s Prime Ten Cryptos Shed Billions Whereas a Few Performed Musical Chairs

Roughly twelve months in the past on Dec. 20, 2021, the crypto economic system was price much more in worth than it’s immediately. 12-month statistics point out that $1.486 trillion has been erased from the crypto economic system since that day, because it slid from $2.334 trillion to the Dec. 20, 2022 worth of $848 billion.

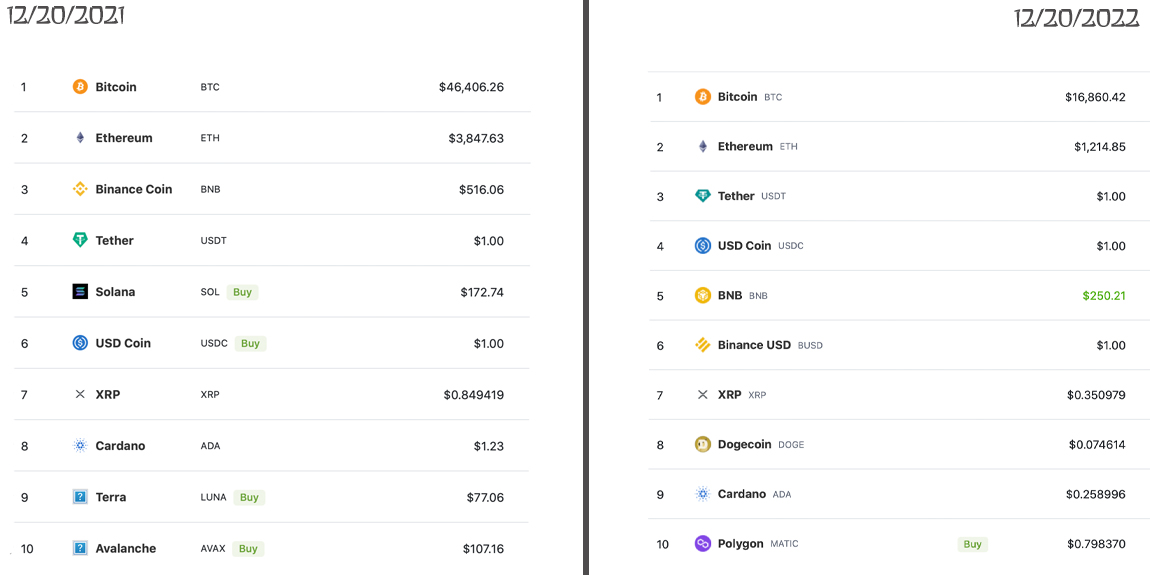

On the time, bitcoin’s (BTC) nominal worth measured in U.S. {dollars} was round $46K per coin and ethereum (ETH) was priced at $3,847 per unit final 12 months. 24-hour world commerce quantity was additionally a lot bigger, as $118 billion in trades had been recorded on Dec. 20, 2021.

At present, the worldwide commerce quantity has been sliced in half, as there’s been roughly $48 billion in swaps recorded on Dec. 20, 2022. Final 12 months presently, the highest ten crypto market cap seemed an entire lot completely different.

A variety of tokens have been displaced from the highest ten, whereas new cash have been added. The highest ten largest crypto market caps final 12 months included bitcoin (BTC), ethereum (ETH), bnb (BNB), tether (USDT), solana (SOL), usd coin (USDC), xrp (XRP), cardano (ADA), terra (LUNA), and avalanche (AVAX), respectively.

12 months later, SOL has been kicked out of the highest ten, LUNA imploded and spiraled beneath a U.S. penny per coin, and AVAX was pushed out of the highest ten standings as nicely. On Dec. 20, 2021, solely two stablecoins existed within the prime ten, and immediately — and for the primary time in historical past — three stablecoins are included within the prime ten spots.

Prime ten stablecoin property again then had been USDT and USDC, and in June 2022, BUSD managed to enter the highest ten positions. New entries into the highest ten presently embody dogecoin (DOGE) and polygon (MATIC).

Final 12 months presently, tether (USDT) had a a lot bigger market valuation at $77.39 billion, whereas immediately it stands at $66.22 billion. USDC’s market cap has elevated over the past 12 months from $42.21 billion to the Dec. 20, 2022 market valuation of $44.43 billion.

twelve months in the past, BUSD’s market cap was $14.54 billion and it stands at $18.06 billion immediately. Moreover LUNA, two cash that had been as soon as prime ten contenders — solana (SOL) and avalanche (AVAX) — have suffered appreciable losses over the past 12 months.

Yr-to-date, SOL has shed 93.2% in opposition to the buck and AVAX has misplaced 89% this previous 12 months. SOL has notched down from the fifth largest market cap to the present 18th place. AVAX was holding the quantity ten spot final 12 months and presently, AVAX is coasting alongside within the twentieth spot.

Whereas dogecoin (DOGE) is a prime ten contender immediately, it had a a lot bigger market cap when it was not included within the prime ten standings. Dogecoin’s market valuation has slipped from $21.78 billion to immediately’s $10.22 billion.

Polygon too, which is now a prime ten coin, used to have a $14.7 billion market cap on Dec. 20, 2021, however immediately the market valuation is all the way down to $7.16 billion. The one anomaly of the small handful of cryptos that bought added to the highest ten and managed to extend its market valuation was the stablecoin BUSD.

12 months in the past, when the crypto economic system’s market cap was $2.334 trillion, BTC had a dominance score of round 38.4% and immediately it stands at 38.3%. Whereas BTC’s dominance didn’t actually flinch, ETH’s dominance, however, moved from 20.2% to 17.3% over the past 12 months.

What do you consider the highest ten crypto coin modifications over the past 12 months? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.