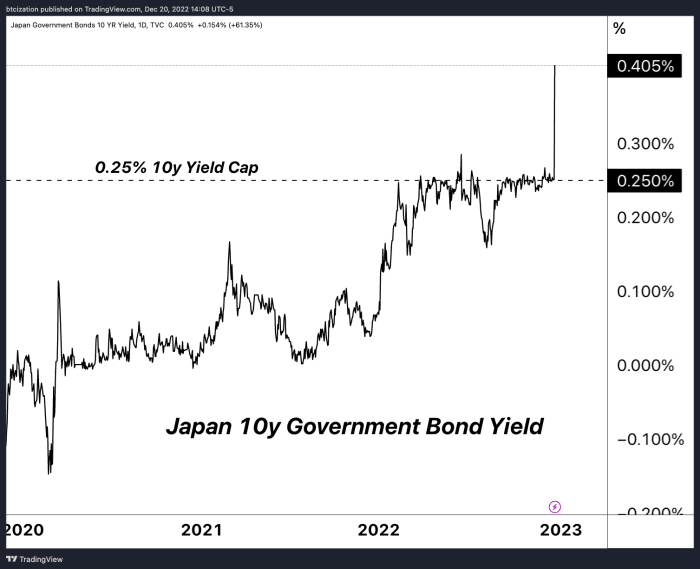

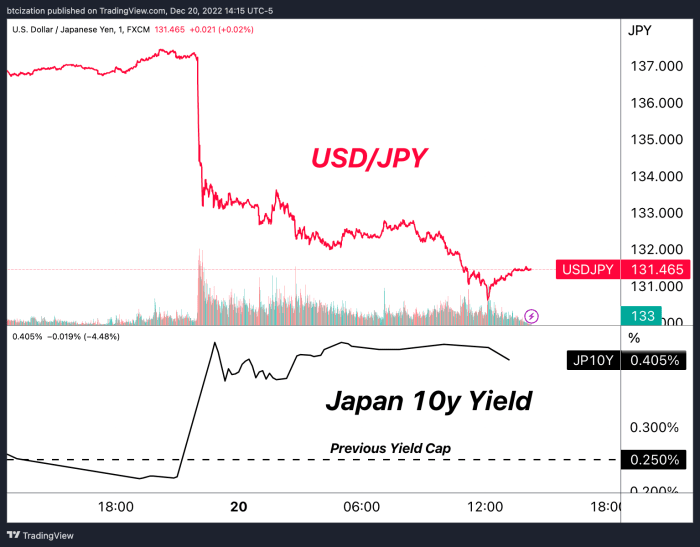

On the night of December 19, the Financial institution of Japan (BOJ) introduced it had elevated its cap on 10-year bond yields from 0.25% to 0.5%, whereas preserving short- and long-term rates of interest unchanged.

Hyperlink to embedded tweet.

The cap on the 0.25% stage had been suppressing international bond markets with the usage of a limiteless cash printer for Japanese debt. This in flip brought about a major deterioration of the yen in opposition to the greenback, whereas the BOJ used its immense pile of Treasurys to often defend the forex in opposition to speculators.

Hyperlink to embedded tweet.

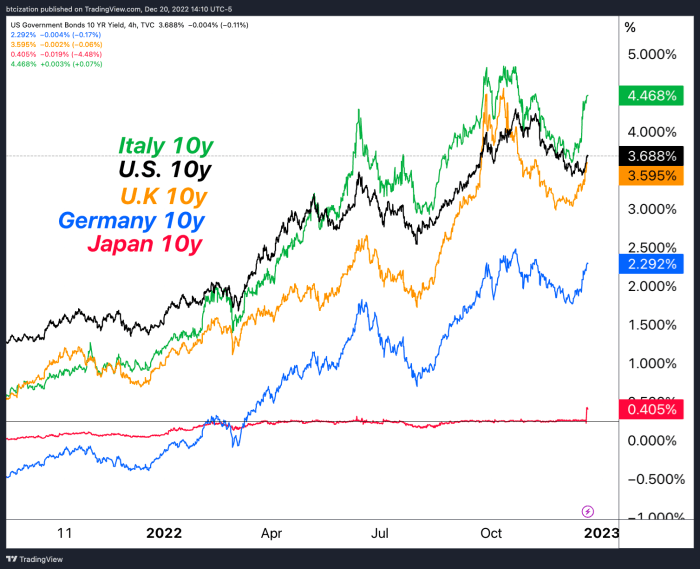

Whereas completely large in its change for market dynamics, the transfer nonetheless leaves the BOJ far beneath its friends when it comes to coverage price, which is principally because of the demographics of Japan and its debt-to-GDP statistics.

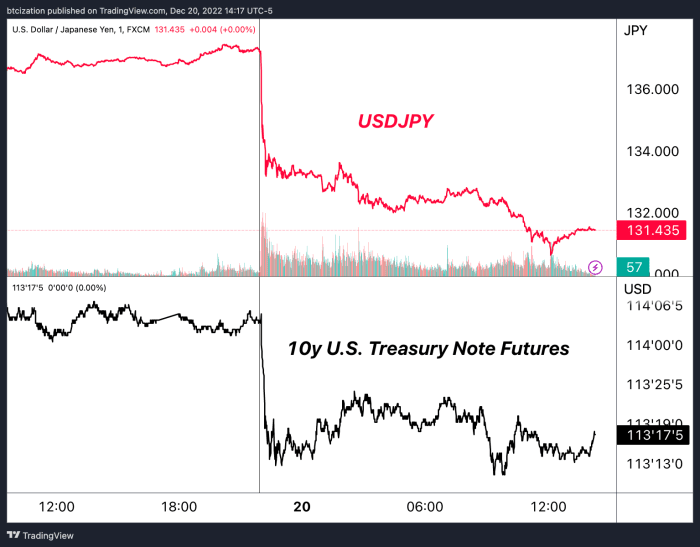

This yield-cap improve, which was surprising by economists, brought about a direct leap within the yen and a slide in international authorities bonds, sending shockwaves by way of international monetary markets. It additionally led to a surge in Japanese financial institution shares, as buyers anticipated improved earnings for monetary establishments.

Financial institution of Japan Governor Haruhiko Kuroda laughing as he hikes charges for the world.

Because the BOJ tightens coverage, Japanese debt turns into comparatively extra engaging and the yen appreciates. This causes charges to tighten in U.S. markets, however causes the greenback to weaken relative to overseas change markets.

As bond yields stay at elevated ranges far above current years, asset valuations primarily based on discounted money flows fall. Whereas many market contributors are ready for the return of 2021-like circumstances for varied monetary markets, understanding how the change in debt markets impacts all different liquid markets and relative valuations is vital.

A historic curiosity expense shock is going on in tandem with the biggest absolute drawdown in asset costs ever. We count on the turbulence solely picks up from right here.

Whereas the bitcoin market has had an enormous deleveraging of its personal already, the “ache commerce” (as many consider it) might merely be an prolonged interval of sideways consolidation because the legacy market dominos begin to fall at an growing frequency.

We count on the subsequent secular bull market to be spurred by accommodative financial coverage responses to the circumstances which are growing now. World monetary market liquidity circumstances, credit score worthiness and asset value valuations seemingly fall farther from right here — till the fiat financial overlords resolve to begin debasing. For higher or worse, that is the secret on the fiat financial normal.

Hyperlink to embedded tweet.

We’re firmly in step three. Regular lads.

Like this content material? Subscribe now to obtain PRO articles immediately in your inbox.