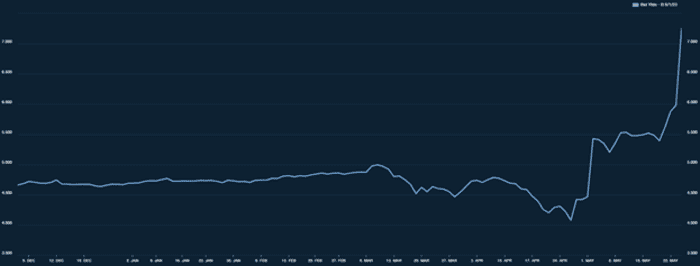

U.S. Treasury yields skilled a notable rise this week, inflicting elevated apprehension available in the market. Notable upswings occurred on Wednesday and Thursday when considerations over the debt ceiling and hypothesis over rate of interest hikes pushed yields to document highs.

Within the early hours of Thursday, Could 25, the yield on the 12-month Treasury invoice reached 5.18%, whereas the 6-month invoice reached 5.41%. The yield on the 3-month invoice reached 5.33%. The ten-year Treasury reached 3.76%, whereas the 2-year Treasury noticed a seven foundation level enhance to 4.46%.

“Treasuries” check with U.S. authorities securities that symbolize the debt obligations of the US authorities because it borrows cash to finance its operations. Treasury yields are the return on funding traders obtain by holding these securities. They’re a significant benchmark within the monetary market, serving as a vital indicator of market sentiment, inflation expectations, and general financial situations within the nation.

Whereas a number of components contribute to the speed of return on Treasury yields, demand is probably the most important. When traders exhibit increased demand, costs enhance, leading to a lower in yields. Conversely, when demand weakens, costs decline, resulting in increased yields.

Moreover, market expectations relating to rates of interest and inflation can considerably influence Treasury yields. If traders anticipate increased rates of interest or inflation, yields are inclined to rise as a mirrored image of the elevated danger related to holding fixed-income securities.

The latest drop in demand for Treasuries can probably be attributed to 2 major components: considerations surrounding the debt ceiling and speculations about impending rate of interest hikes.

Because the U.S. nears its debt restrict, there’s growing uncertainty in regards to the authorities’s means to meet its monetary obligations. This uncertainty prompts traders to demand increased yields to compensate for the perceived danger. Moreover, the potential for rate of interest hikes launched by the Federal Reserve provides to the market’s unease, as increased charges would influence the worth of current fixed-income investments.

The market’s concern relating to the debt ceiling turns into evident when analyzing the 1-month Treasury invoice. On Wednesday, Could 24, the 1-month invoice maturing on June 1 reached multi-decade highs of seven.226%. This means that traders have been dumping their short-maturity payments, fearing the prospect of a technical default on June 1 if the debt ceiling negotiations fail.

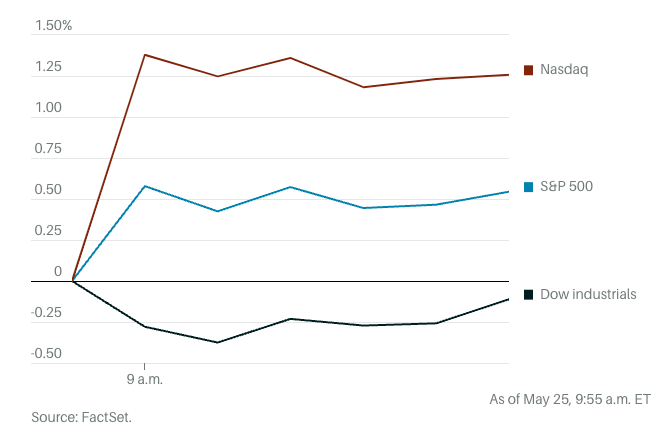

The surge in Treasury yields has important implications for the broader monetary market. It will increase borrowing prices and causes increased rates of interest for all sorts of borrowing, dampening shopper spending and enterprise investments. Rising Treasury yields may also trigger downward stress on the inventory market, because the excessive yields of fixed-income investments turn out to be comparatively extra enticing than shares.

The inventory market is experiencing elevated volatility, with traders weighing the financial well being of the market amid the debt ceiling talks. All three main indices within the U.S. noticed a hunch late Wednesday after Fitch Scores put the U.S.’ AAA long-term score on a unfavourable watch. Dow Jones Industrial Common futures have been down by 86 factors, or 0.3%, early on Thursday. S&P 500 futures have been up 0.6%, and Nasdaq 100 futures have been up 1.4%. Nonetheless, the optimistic motion seen in S&P 500 and Nasdaq 100 futures could be attributed to the distinctive efficiency from Nvidia (NVDA), which despatched tech shares rallying.

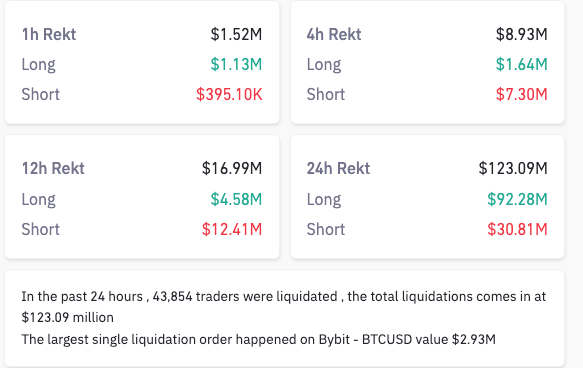

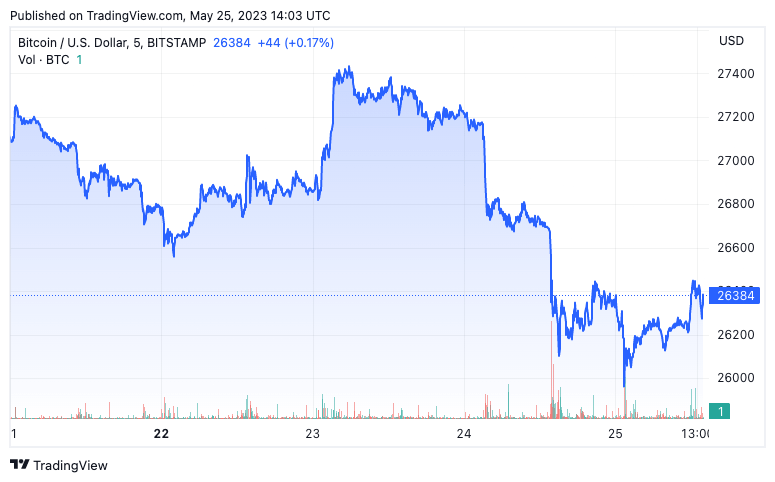

The cryptocurrency market can be affected by the rise in Treasury yields. Bitcoin tumbled under $26,000, triggering a $120 million liquidation storm principally made out of lengthy positions.

The spike in liquidations suggests an inverse relationship between treasury yields and BTC. As yields rise, investments usually divert from riskier property resembling Bitcoin. And whereas institutional traders could be shifting capital into fixed-income investments with rising returns, retail traders could be involved in regards to the worth volatility that might come up from one other rate of interest hike.

The submit U.S. Treasury yields soar and Bitcoin stumbles amid debt ceiling, charge hike considerations appeared first on CryptoSlate.